When we talk about “quality” in investing, it’s not just a buzzword–it’s a crucial factor that directly impacts how a stock performs, especially during volatile market periods. Understanding the difference between high-quality and low-quality stocks can be the key to building a portfolio that doesn’t just survive but thrives, no matter what the market throws at you.

What Makes a Stock High or Low Quality?

High-Quality Stocks:

These are the companies with strong balance sheets, consistent earnings, and reliable cash flows. They have solid business models, competitive advantages, and a history of rewarding shareholders through dividends or share buybacks. Think of companies like Johnson & Johnson, Procter & Gamble, and Microsoft–industry leaders with a proven

track record.

Low-Quality Stocks:

On the flip side, low-quality stocks usually carry high debt, show inconsistent earnings, and have weaker cash flows. These companies often operate in highly cyclical industries, have lower profit margins, or face significant competitive pressures. While they might offer high growth during bull markets, they’re also the first to crumble when times get tough. Think of speculative tech startups or highly leveraged firms–they might promise the moon, but they also carry the risk of a hard landing.

The Rise of Low-Quality Stocks During Market Exuberance

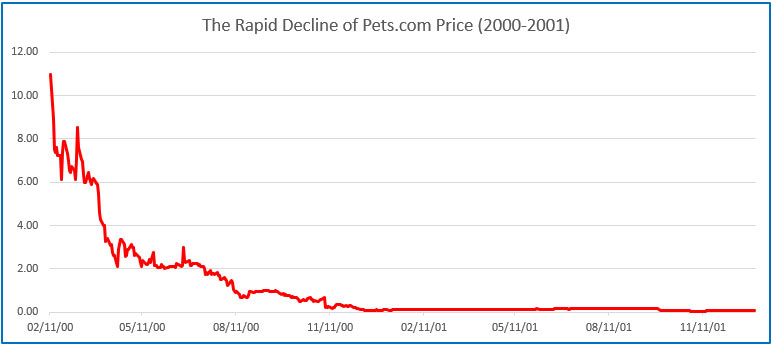

When markets are flying high and investor sentiment is positive, low-quality stocks can rally hard. This is largely driven by speculation, risk-taking, and a tendency to overlook fundamentals. A classic example is the Dot-Com Bubble of the late 1990s, where investors poured money into tech startups with unproven business models. Companies with little to no profits and vague business plans skyrocketed in value–until reality set in.

Exhibit 1 – Pets.com went from $11/share in 2001 to a penny a share in 2004 (Source: Factset)

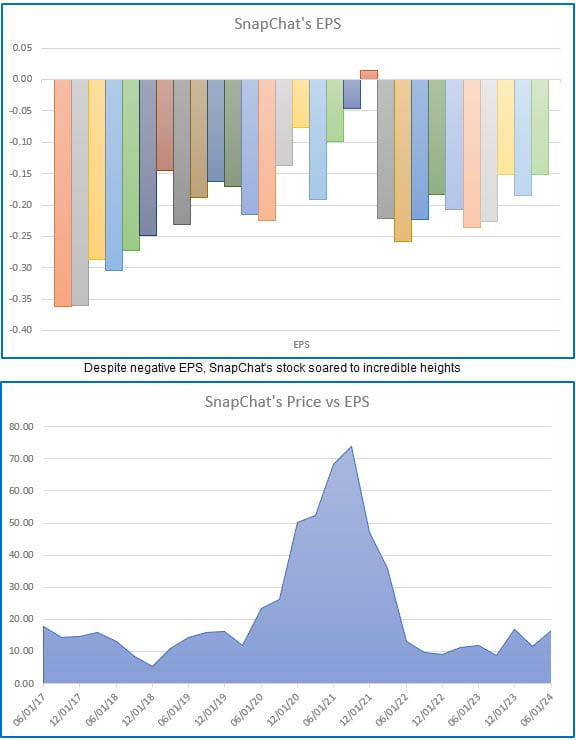

More recently, we saw a similar pattern with the stock of SnapChat (SNAP). The enthusiasm around Snap’s IPO was driven largely by hype and the excitement surrounding the company as a leader in the social media space, particularly among younger users. Investors were eager to get in on the ground floor of what they hoped would be the next Facebook. However, Snap’s fundamentals did not support the lofty valuations – in fact, their earnings have been negative for all but one quarter – when they earned a penny! This was because the company faced intense competition from larger players like Facebook (especially Instagram) and had limited avenues for monetization.

As the initial excitement wore off, investors began to scrutinize Snap’s financials more closely. Concerns about user growth, competition, and the company’s ability to generate sustainable revenue led to a significant decline in the stock price. Within a few months of the IPO, Snap’s stock fell below its IPO price, and by mid-2017, it was trading around $12 per share, a sharp decline from its post-IPO highs.

Exhibit 2 – SnapChat’s price vs EPS (Source: Factset)

The Flight to Quality During Market Stress

When the market shifts from exuberance to stress, everything changes. Investors suddenly become more risk-averse, seeking safety in high-quality stocks, bonds, or even cash. This “flight to quality” is often triggered by fears of economic downturns, rising interest rates, or geopolitical tensions.

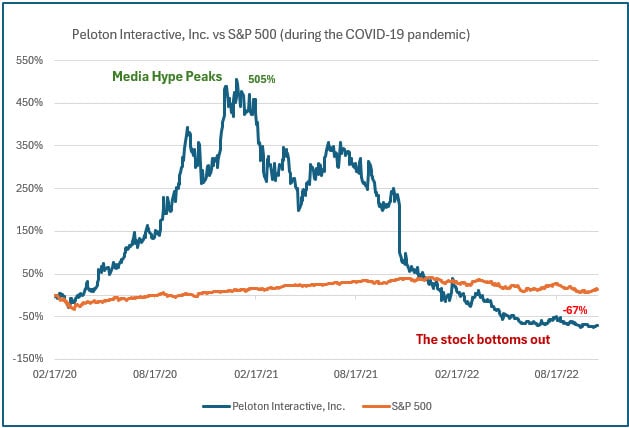

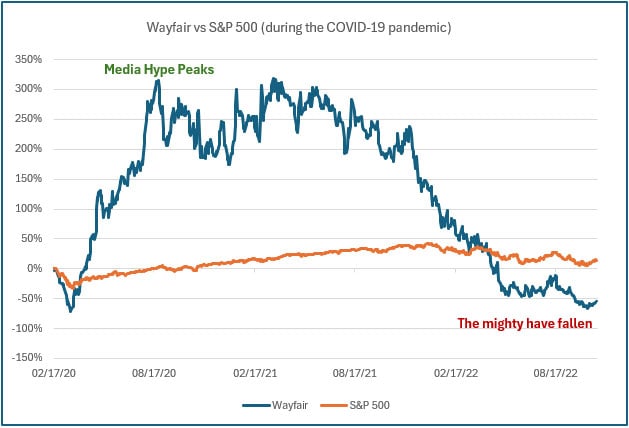

The COVID-19 pandemic produced a multitude of examples. As markets panicked, investors fled from speculative, low-quality companies into the safer territory of high-quality stocks. Companies with strong digital infrastructure and essential services, like Apple, Microsoft, and Amazon, saw their stocks recover quickly. In contrast, sectors like travel, leisure, and energy, many of which had weak balance sheets, suffered steep and prolonged declines. All the while, the media was quick to sprinkle in an added dose of hyperbole amid the panic, ensuing mania, and eventual crash of some very well-known names:

1. Peleton

- Pandemic Surge: Home fitness boomed as gyms closed, leading Peloton to soar in popularity and stock price.

- Post-Pandemic Decline: With gyms reopening and demand waning, Peloton faced production issues, supply chain problems, and a massive stock price drop.

2. Wayfair

- Pandemic Surge: Wayfair saw a surge in demand as homebound consumers spent more on furniture and home goods, driving its stock price to new highs.

- Post-Pandemic Decline: As the economy reopened and consumer spending shifted back to experiences like travel, Wayfair’s stock plummeted due to weakening demand and rising costs.

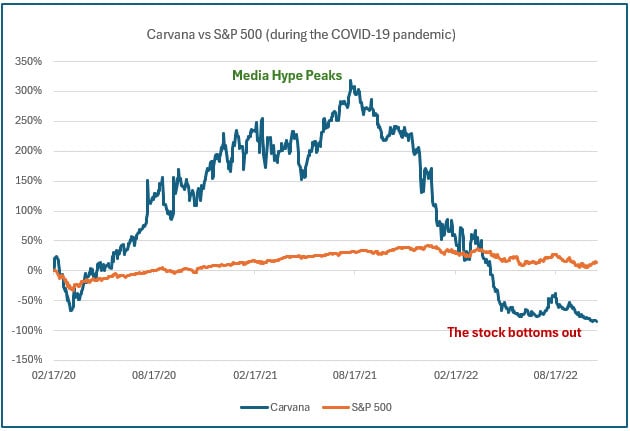

3. Carvana

- Pandemic Surge: The used car market boomed during the pandemic as supply chain disruptions made new cars scarce, causing Carvana’s stock to skyrocket.

- Post-Pandemic Decline: As the market normalized, Carvana struggled with inventory issues and debt, leading to a steep decline in stock value.

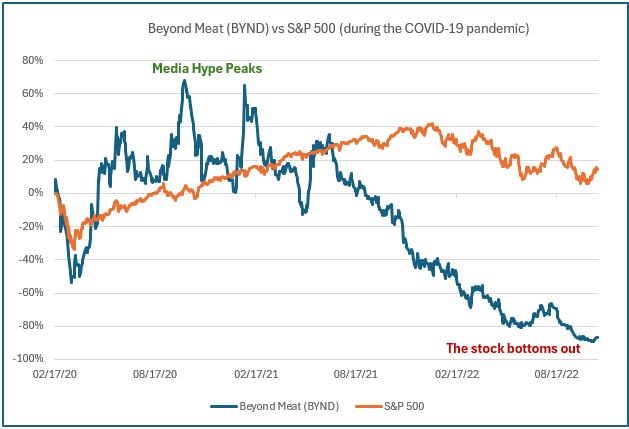

4. Beyond Meat

- Pandemic Surge: Beyond Meat benefited from increased attention on alternative foods during the pandemic, with media hype around plant-based diets and health trends pushing its stock price up.

- Post-Pandemic Decline: The stock lost significant value as competition increased and growth failed to meet the high expectations set during the pandemic.

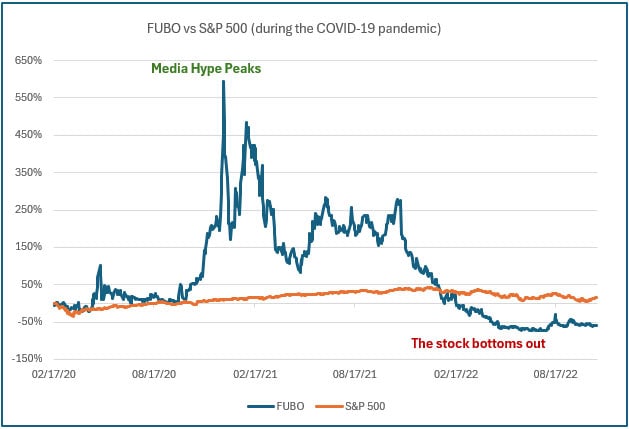

5. FUBO

- Pandemic Surge: FuboTV attracted investor attention as the cord-cutting trend accelerated during the pandemic, with media highlighting its potential in sports streaming.

- Post-Pandemic Decline: The company struggled with profitability, and competition from larger players like Netflix and Disney+ led to a substantial decline in its stock price, falling from pandemic highs.

The pattern, in all the aforementioned cases, is the same. The company has a product or service that is highly favored by a large portion of the population, the media oversells it – driving up their price to atmospheric heights and, in the process, foments irrational exuberance which nearly always leads to a rapid and shocking crash as the stock’s price falls back to pre-hype levels, and in most cases even lower due to the reversed momentum of negative investor sentiment.

Why Quality Should Be Central to Your Long-Term Portfolio

For investors focused on long-term success, understanding the role of quality is critical. While low-quality stocks can deliver impressive short-term gains during speculative rallies, they can also lead to painful losses during downturns. High-quality stocks, with their stable earnings and strong cash flows, offer a level of safety and stability that’s essential for a well-diversified portfolio.

Final Thoughts

Quality plays a significant role in how stocks behave during different market conditions. Low-quality stocks may soar when the market is hot, but they’re also the first to fall when things cool off. On the other hand, high-quality stocks provide a safe harbor during storms, helping you achieve long-term growth while minimizing risk. By prioritizing quality in your investment strategy, you can better navigate the market’s inevitable ups and downs with confidence and success.

Exhibit 5 – Characteristics of high quality vs low-quality stocks

Focusing on quality is not just about minimizing risk–it’s about ensuring your portfolio can stand the test of time. And this is why it is so vitally important to spread one’s risk across multiple asset classes.