Portfolio returns can generally be divided into two categories: annual returns and average annual returns. While they may sound similar, average annual returns are often misunderstood by investors. This misunderstanding, combined with media influence and large firms promoting recent returns, can cause investors to chase results that have already occurred. Wall Street mutual fund companies frequently advertise strong recent average returns to promote overvalued securities. Because of this, one of the most reliable ways to seek to achieve long-term success is to build a diversified portfolio of high-quality stocks and bonds across different sectors.

Annual vs. Average Annual Returns

Annual returns represent the performance of an investment over a 12-month period. For example, if you invested $1,000 and earned an 8% annual return, your investment would grow by $80 over the year. While annual returns are straightforward, average annual returns are more complex and often misunderstood.

Average annual returns are the constant rate of return that would generate the same total growth as actual fluctuating returns over time. This calculation smooths out year-to-year fluctuations and provides a long-term perspective on performance. However, since average annual returns are based on historical data, they can be skewed by recent results, leading investors to make poor decisions based on short-term trends.

The Recency Effect and Investor Behavior

A psychological phenomenon known as the “recency effect” can significantly impact investor behavior. People often place too much emphasis on recent information, which can lead them to chase overvalued assets or abandon undervalued ones. For example, if a growth stock rally inflates average returns, investors might be tempted to shift their focus toward growth stocks, even though they may already be overvalued.

Example 1

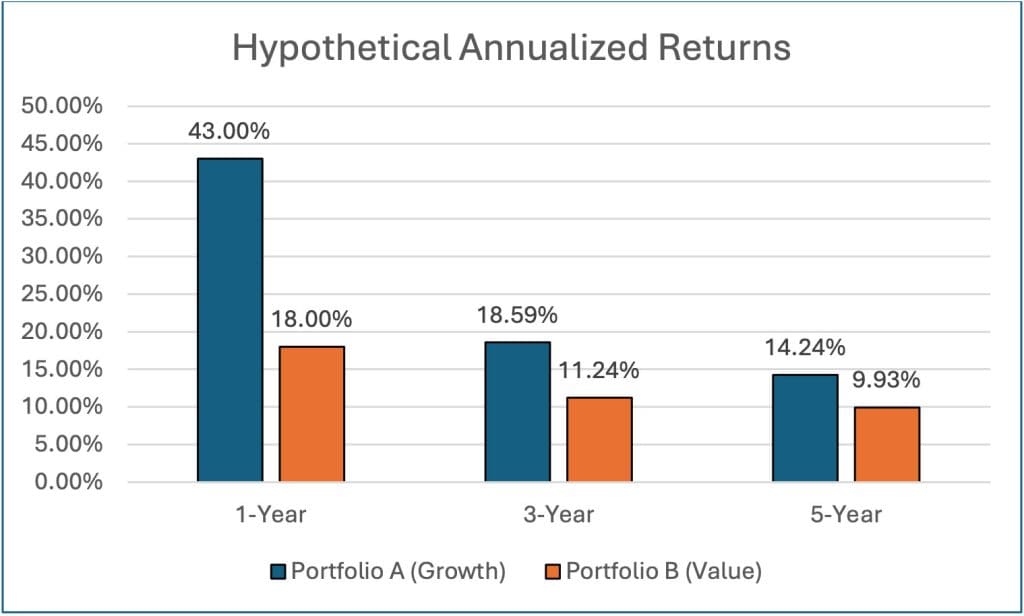

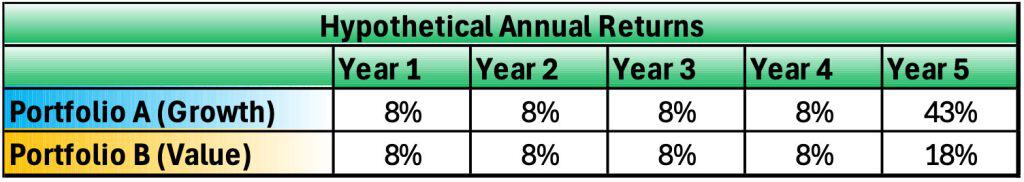

Consider two hypothetical portfolios: Portfolio A, which leans towards growth stocks, and Portfolio B, which favors value stocks. Both portfolios perform equally well for the first four years with each generating an 8% annual return. In the fifth year, however, growth stocks experience a 43% rally, while value stocks return only 18%. This drastic difference significantly impacts each portfolio’s average return.

If an investor in Portfolio B switched to growth stocks based on the higher average returns, they could be in for a rude awakening if growth stocks subsequently decline.

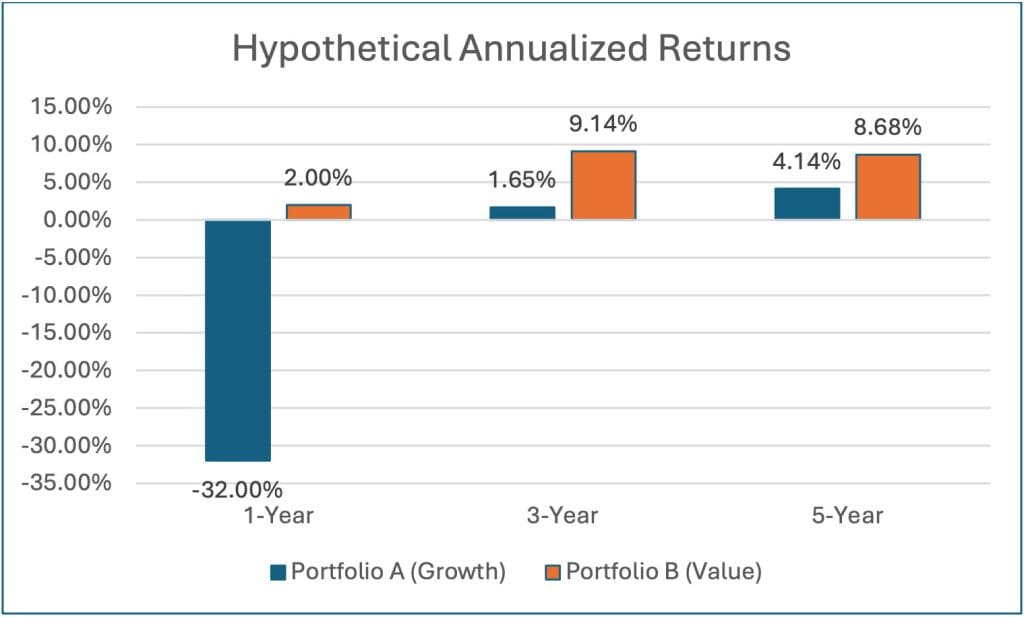

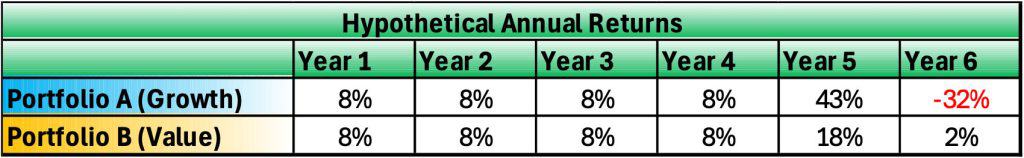

At the end of year 5, Portfolio A’s 1-, 3-, and 5-year average return suggested that Portfolio A was the stronger performer, but in year 6 the opposite was true. This highlights how a single year’s return can flip average returns on their head.

Example 2

Twelve months can change average returns a great deal. All the more reason to resist chasing or abandoning asset classes or sectors. When good stocks rally, don’t chase them; and when good stocks and bonds go down, don’t sell. Rather, this is the time to add shares! Be careful not to allow average annual returns to lead you into doing something you’ll regret.

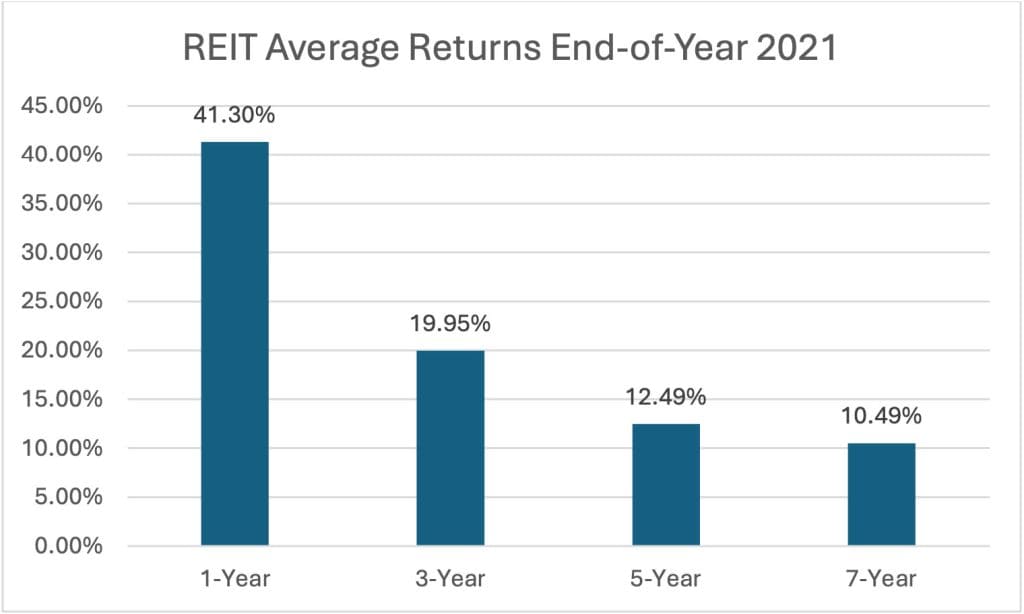

Source: JP Morgan Guide to the Markets (NAREIT Equity REIT Index)

(an index is unmanaged, and you cannot directly invest in an index)

(Past performance is no guarantee of future results)

An uninformed investor could view these average returns as proof of REITs (Real Estate Investment Trusts) dominance over several years and decide to sell their other holdings to increase exposure to REITs. If the investor built their initial portfolio with a focus on diversification, quality, and direct ownership, they shouldn’t change course just because of recent results. The next year’s average returns could tell a very different story:

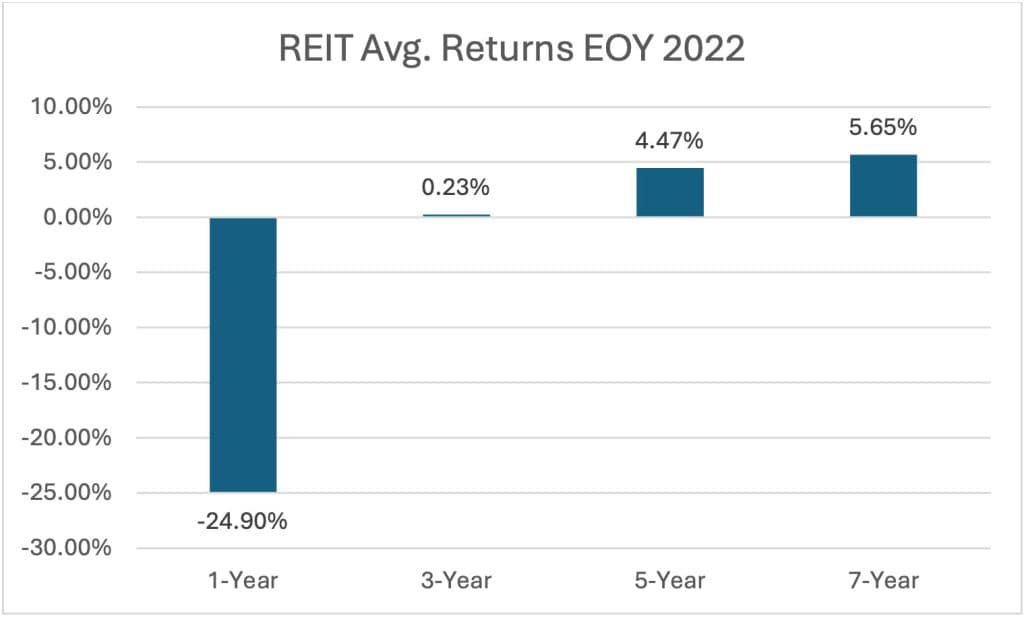

Source: JP Morgan Guide to the Markets (NAREIT Equity REIT Index)

(an index is unmanaged, and you cannot directly invest in an index)

(Past performance is no guarantee of future results)

All of this hand wringing and market chasing ultimately results in frustration and can lead to poor results. It is better to construct a strategy up-front and stick to it. Of course, tactical adjustments to the strategy can be made at any time, but simply reacting to the latest results can be a recipe for disaster.

Once again, average returns can change quickly, and it is often unwise to pursue an asset class just because of recent high average returns. One benefit of diversifying across different sectors is that you don’t have to chase the results of sectors as they move into and out of favor from year to year.

The Dangers of Chasing Sectors

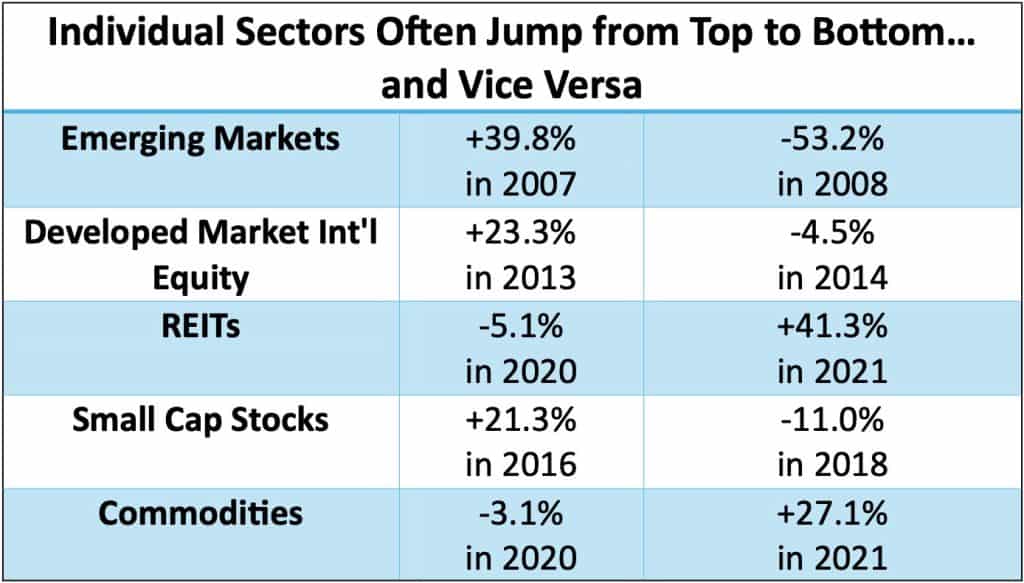

Market cycles can last anywhere from 10 to 20 years, so even average returns over 7 or 10 years may not fully capture the performance of a sector. A sector’s strong performance in one year can heavily influence 1-, 3-, and 5-year average returns, which can mislead investors into chasing gains that have already occurred.

All sectors have rallies and pullbacks. It can be challenging to avoid chasing returns when rallies take place and impact average returns positively, or to avoid selling holdings when a sector moves down and is impacted negatively. In the case of the five sectors below, when sectors do well or poorly the average returns are altered, but this doesn’t mean next year will tell the same story:

Source: Zephyr. (Past performance is no guarantee of future results)

Diversification and Discipline

Investors can avoid the pitfalls of chasing returns by diversifying their portfolios and sticking to a disciplined strategy. By spreading investments across different asset classes and sectors, investors can position themselves to benefit from whichever sector is performing well in a given year. All too often investors chase average returns that are inflated by recent annual results without considering the downside.

At Linden Thomas & Co., we emphasize the principles of portfolio efficiency theory: diversify risk across growth, value, dividend stocks, and small-, mid-, and large-cap stocks; invest in high-quality companies with strong earnings; maintain direct ownership for control and transparency; and practice patience. While this approach might not generate headline-grabbing returns every year, it has been able to deliver solid results over the long term while helping to minimize the impact of down-markets and delayed recoveries, restoring long-term compounding. Chasing the markets is like betting on a horse after it’s already won the race. Spread risk, and let the market come to you.

Long-Term Investing and Avoiding Hype

If history has taught investors anything, it’s that high current returns don’t mean high future returns. Some of the best times to invest are after a sector has a pullback, and some of the worst times to invest are after a sector has a rally. When sectors fall out of favor, the 1-,3-, and 5-year average returns are so poor that many investors think there is something wrong. However, history shows that the majority of sector gains happen shortly after a pullback, meaning that by the time average returns rise, most of the rally may have already occurred. Those who jump into a sector late may find themselves stuck when the sector begins to falter.

The key is to stay diversified and avoid chasing hot sectors. During market dips, it’s often better to add to weaker-performing sectors rather than abandoning them. Quality holdings, direct ownership, and time are essential elements to successful investing. This applies not only to stocks but also to bonds, where the income from high-quality bonds can provide long-term stability, even when bond prices decline.

Despite the evidence, most investors fail to realize that the best results are achieved over long periods of time. Over 38 years we have seen first-hand how patient investors outperform those who are chasing results. It’s no surprise that time in the market is more important than timing the market.