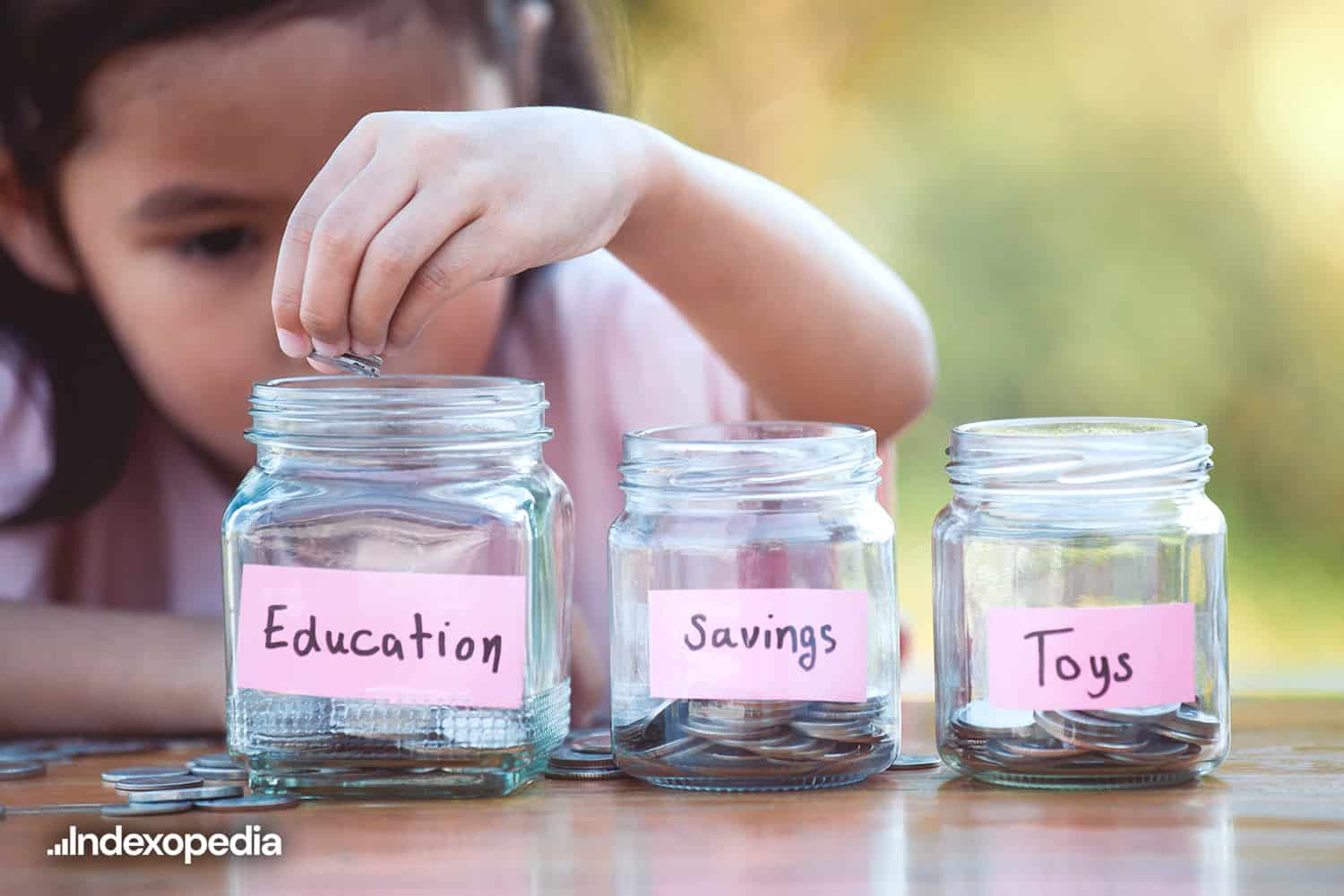

Teaching children about money is an investment in their future financial well-being. While many parents find it difficult to introduce financial concepts, early exposure helps build confidence and encourages responsible money management. From understanding the basics of saving to making informed investment decisions, financial education is a gradual process that evolves with age. The following steps outline how to instill financial literacy at different stages of childhood and young adulthood. 1. Lay the Foundation Early Financial habits begin forming at a young age, making early exposure to money concepts essential. Encouraging young children to handle physical money–such as coins and bills–helps them recognize its value. Using a piggy bank to store chore earnings or gift money introduces basic saving principles in a tangible way. Opening a savings account around age five can reinforce these lessons. With parental guidance, children can participate in small banking tasks, such as making deposits or tracking their balance. Discussing spending decisions, distinguishing between necessities and luxuries, and setting aside a portion of savings for charitable giving can help shape responsible financial attitudes. 2. Introduce Investing Concepts As children grow, introducing