No investor wants poor results. While seeking the best results can be healthy, chasing results can have horrible outcomes. It’s important to understand why and how investors who seek good results often fail to actually achieve them. Seeking and achieving good portfolio results starts with understanding how good results are truly generated.

First, one must understand that when one’s investments end up with good returns, it generally means that the investment was made before those results took place. Results are like racehorses—once a horse has won the race, it’s easy to pick out the winner. Yet while they’re in the gate before the race, it’s anyone’s guess who’s going to win. That’s why they call it gambling. We bet on who we think may win, but we’re not promised or guaranteed anything.

Investing is not gambling—but it becomes gambling when you move from one sector to the next after a sector does well. So, what does horse betting have in common with investing? Not much—unless, like in racing, you’re constantly moving from one sector to the next in hopes of catching a winner.

Let’s look at this in more detail. True investing is when we invest our dollars in several stocks or sectors with the goal of achieving good results over a long period of time. Investing consists of three factors:

- Investing monies into companies

- Spreading risk between companies and sectors of the market

- Giving the portfolio or companies time to grow

If we remove any of the three factors from above, then we are just gambling. For example, instead of spreading risk between sectors, you invest in just one. Well, that’s a bet. You’re betting on that sector to do well.

So how does one know they’re an investor versus just gambling? Investors often invest in several sectors and wait for those sectors to do well. As investors, we must have patience for the long-term outcome. Investors have a long-term perspective, waiting for the markets to come to them. Gamblers are often impatient and change lanes frequently.

Because investing takes patience, let’s look at a couple of examples of how patience paid off, yet impatience was penalized.

The Patient Investor vs. The Impatient Investor

At the core of investing is buying companies that, over a long period of time, will grow. The challenge is, no one is 100% certain which companies or sectors will do well from year to year. So, as investors, we spread risk.

As an example, in the case of the Linden Thomas & Co. equity indexes, there are 16 earnings-focused indexes, each representing a different style or sector. The goal of the 16 indexes is to give investors the ability to build a portfolio tailored to their specific long-term goals. The challenge is that no one knows from quarter to quarter or year to year which sector will do better. This is why investors spread risk and wait patiently.

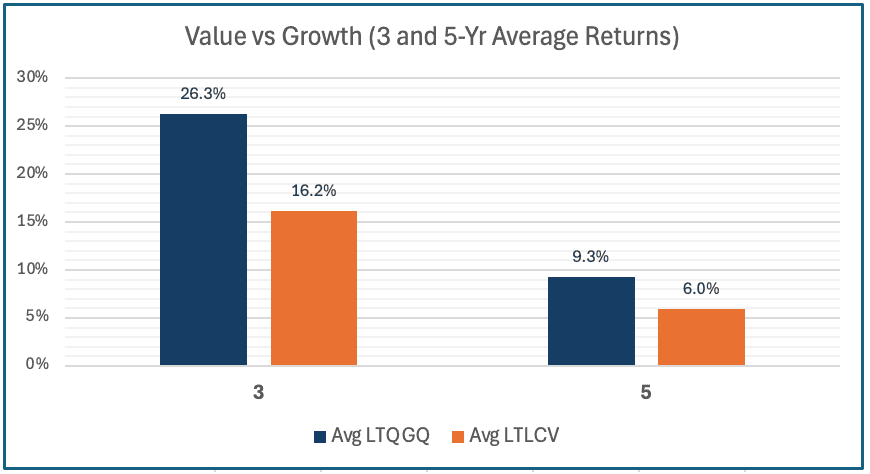

So why is waiting versus chasing important? Reviewing the chart below may help shed light on this subject.

Growth vs. Value Sectors

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

As you can see from the above chart, the Linden Thomas & Co. Growth Index was up +43.1% versus the Value Index’s +17.2% in 2020. Both were respectable results. However, because of the one-year high in growth, this greatly lifted the average annual results, as seen below.

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

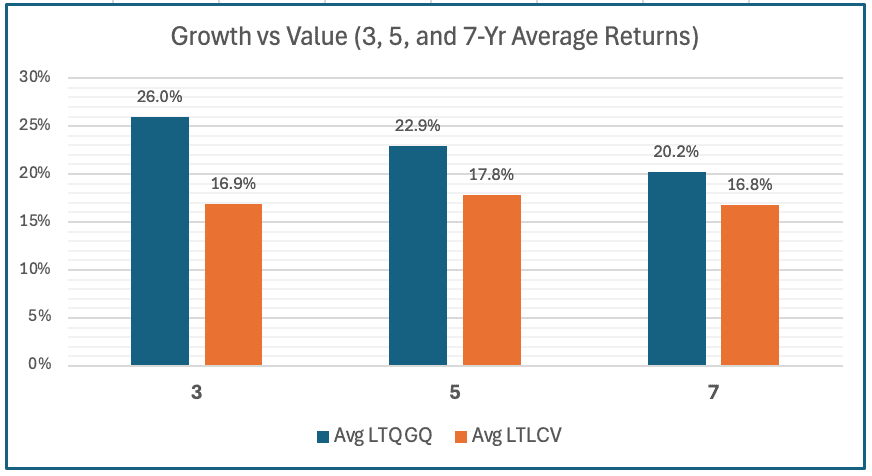

Because of the spike in growth returns in 2020, the 3-, 5-, and 7-year averages were much higher for growth. That one-year spike created a 3.4% annual difference over 7 years. When this happens, investors often believe they are missing out, yet fail to understand that the one-year spike is what lifted the average.

When investors fail to understand the importance of spreading risk and being patient—and instead begin moving toward what is perceived as the more favorable sector—they shift from being investors to becoming gamblers. The danger of chasing sectors rather than investing and waiting is that sectors dominant for a season often become overvalued.

Like betting on a racehorse after it won the last race—it might be tired!

Pictures and Results Change

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

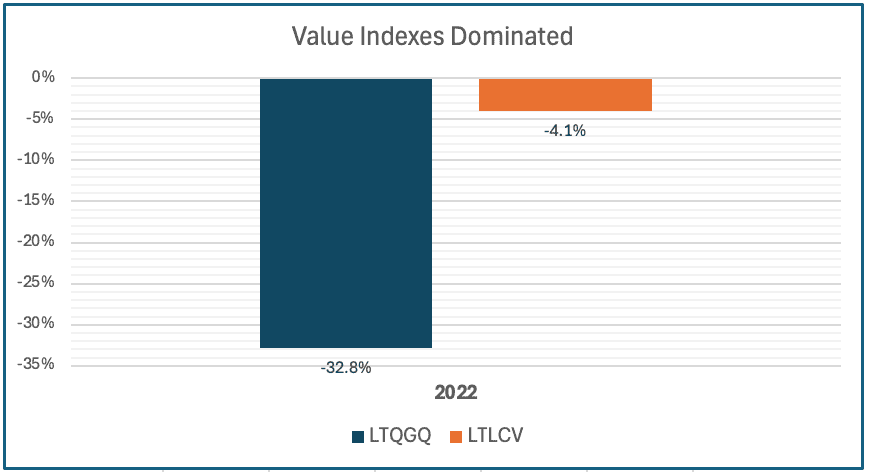

By 2022, the picture between growth and value changed significantly. As you can see, the growth index that had been up significantly just months earlier—which lifted the average—now produced very different results.

If you had moved from value to growth at the end of 2020 seeking better results, the sad fact is that you moved from a fairly valued sector with low risk to one that was highly valued and carried higher risk.

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

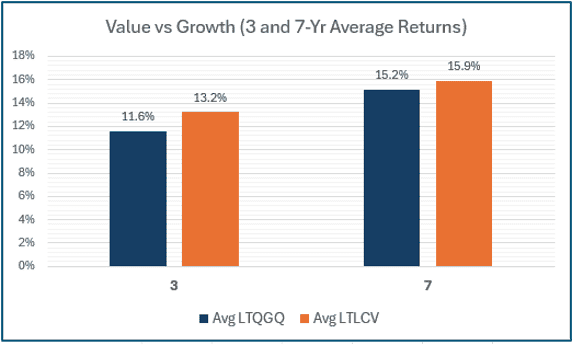

Now look at the averages of both. The 7-year average returns after the 2022 pullback were within just half a percentage point. Investors who remained patient and spread risk didn’t need to worry about chasing sectors—they know sectors rise and fall. The sad fact is, many investors who constantly seek better results end up moving from one fund or one firm to another, investing in something that’s already happened.

Why Risk Is Relative

Over the last several years, growth stocks have led the charge in results. So, many investors who haven’t spread risk between growth and value stocks may jump ship from traditional sectors like value in search of more growth.

But even without a pullback, growth has seasons of strong results. Why? Because company price and earnings matter. In the short term, stocks can move from discounted to overvalued levels quickly. The challenge is that you never know when a sector will shift from laggard to leader. That’s why one should always spread risk.

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

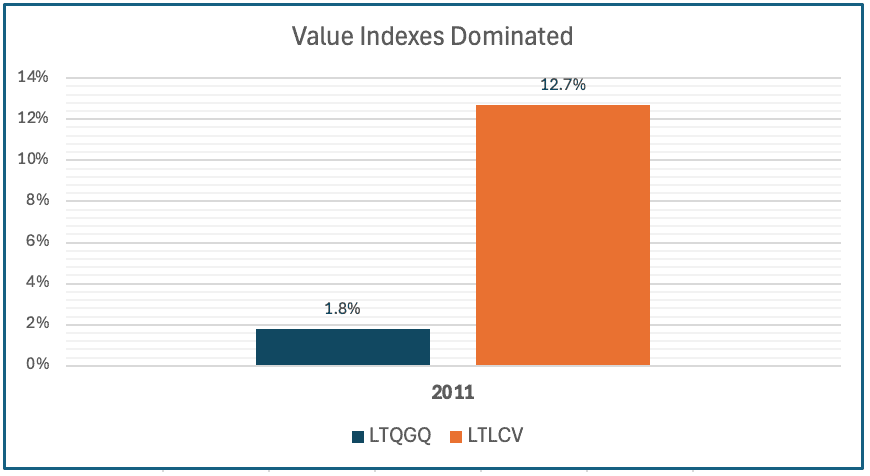

As you can see, from 2011 back-tested results, value outperformed growth. Yet as shown below, the average return still favored growth.

(These hypothetical returns and time periods shown are included strictly for illustrative purposes. These returns are not reflective of any investment strategy by the investment adviser nor are they the results of any client account managed by the adviser)

So, what’s the conclusion in all this? Investing in quality stocks and spreading risk between sectors over long periods of time gives you a greater probability of success than chasing what has already happened.

“Remember: Time in the market is more important than timing the market.”