Crypto Nightmare: The Backpage Stories They Don’t Want You to See!

Are Layoffs Always a Bad Thing?

What Happens When Average Returns Flip?

If Down-Markets are Normal, Why Should I Invest?

Market Environments Across the Business Cycle

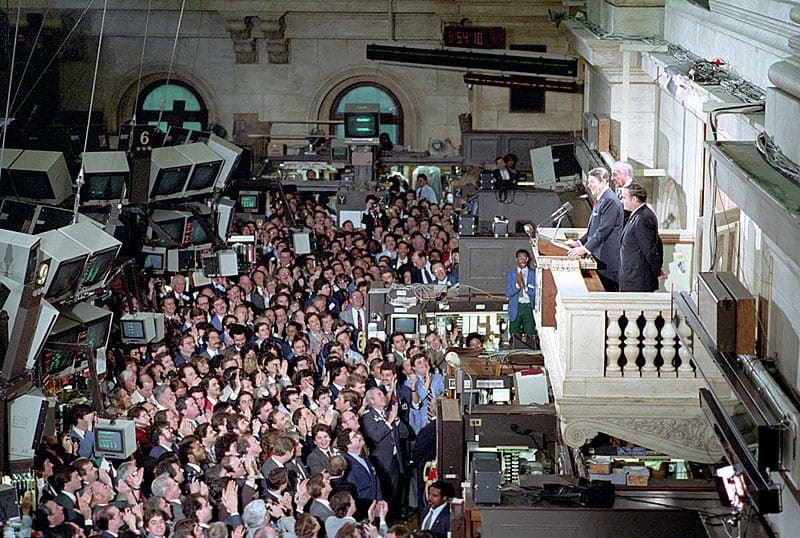

When/How Were Stocks Invented?

How is United States’ Economy Different from Other Countries?

Why Are Down Markets Your Friend?

What is the difference between capital markets and money markets?

Why are Markets Important?

How does a 1000 Point Drop Compare with History?

What are stock splits? How does it affect me as an investor?

The History of Markets

Building a portfolio with a correction in mind vs timing the correction

The Market’s at an All-Time High. Why Should I Keep Investing?

The Media’s Role in Fueling Market Hysteria: Lessons for the Prudent Investor

Quality vs. Volatility: The Impact of Stock Quality on Market Swings

The Power of Diversification: How Different Asset Classes Complement Each Other in a Balanced Portfolio

The Market Is Like a Coin—It Has Two Sides: Up and Down

How Down Markets Can Actually Benefit Investments in Bonds and Dividend Stocks

Cryptocurrency Nightmares: The Hidden Dangers Every Investor Should Know

Surviving a Market Correction: What Every Investor Needs to Know

What If You Miss the Best Part of the Recovery

What Should I Do in a Bear Market?

Understanding Stock Splits: Why Companies Do Them and What It Means for Investors

Historical examples of hot sectors that didn’t end well

The Diversification Challenge

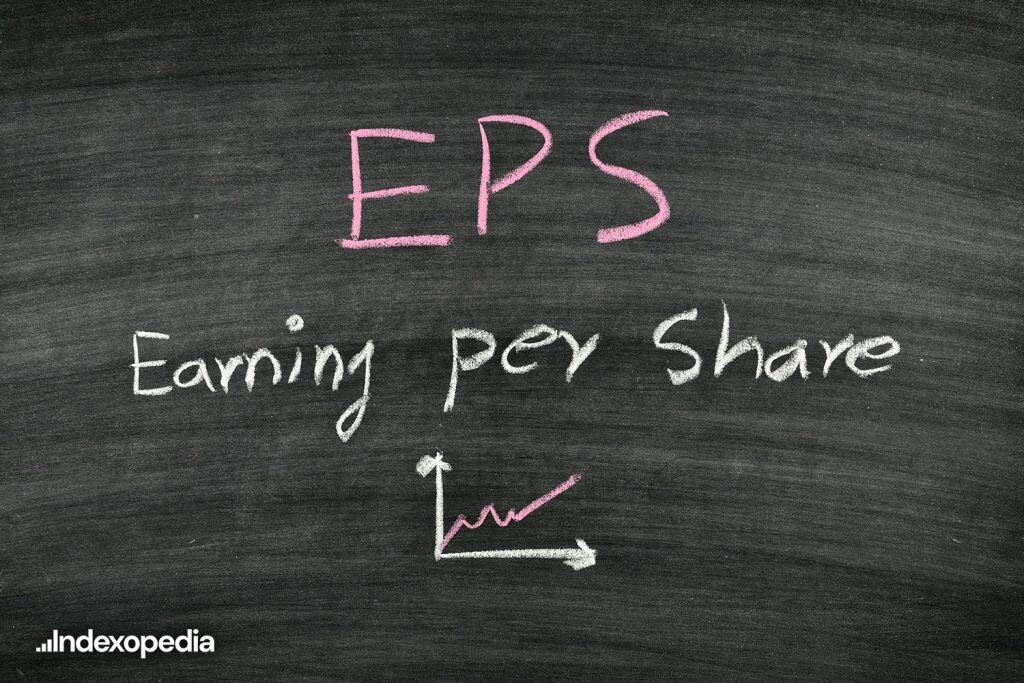

What is EPS?

What was The Great Depression?

What is OPEC?

What is Diluted EPS?

What is Cryptocurrency?

What are Credit Ratings?

What is Insider Trading?

What is ESG Investing?

What are Penny Stocks?

What are Dividends?

What are Stocks?

What are Emerging Markets?

What is the Dividend Discount Model?

What are Defensive Stocks?

What is Default Risk?

Volatility

Value Stocks

Valuation

Stock Buybacks

What are Market Cycles?

Short Selling

Real Estate Investment Trust

What is Timing the Market?

Qualified Dividends

What is Shareholder and Proxy Voting?

Price to Sales

Price to Book Ratio

Market Pullbacks

Preferred Stock

What is Market Share?

What is Market Cap?

Exchange Rates

IPO

Income Statements

Understanding Income

What are Growth, Value, and Dividend Stocks?

Growth Stocks

What is Earnings Quality?

Dividend Yield

Dividend Stocks

What is Channel Stuffing?

Breakeven Price

Blue-Chip Stocks

What is Beta?

What is a Balance Sheet?

Asset Turnover Ratio

Asset Coverage Ratio

What are ADRs?

Accrual vs. Cash Accounting