Teaching children the importance of saving and investing is a valuable life lesson that can set them up for financial success. By fostering good habits early, parents can instill a mindset that balances responsibility with long-term thinking.

One of the biggest challenges of teaching our kids how to save money is conveying the importance of saving a little early on, rather than saving a lot later in life. While this can be hard to teach kids, it’s equally important for adults to understand. Saving just a little over a long period of time can end up growing to a significant sum. Teaching children the power of time in relation to savings and investing is so important, and if they grasp this concept and maintain discipline, they will be able to empower the next generation to do the same. Let’s look at 3 examples:

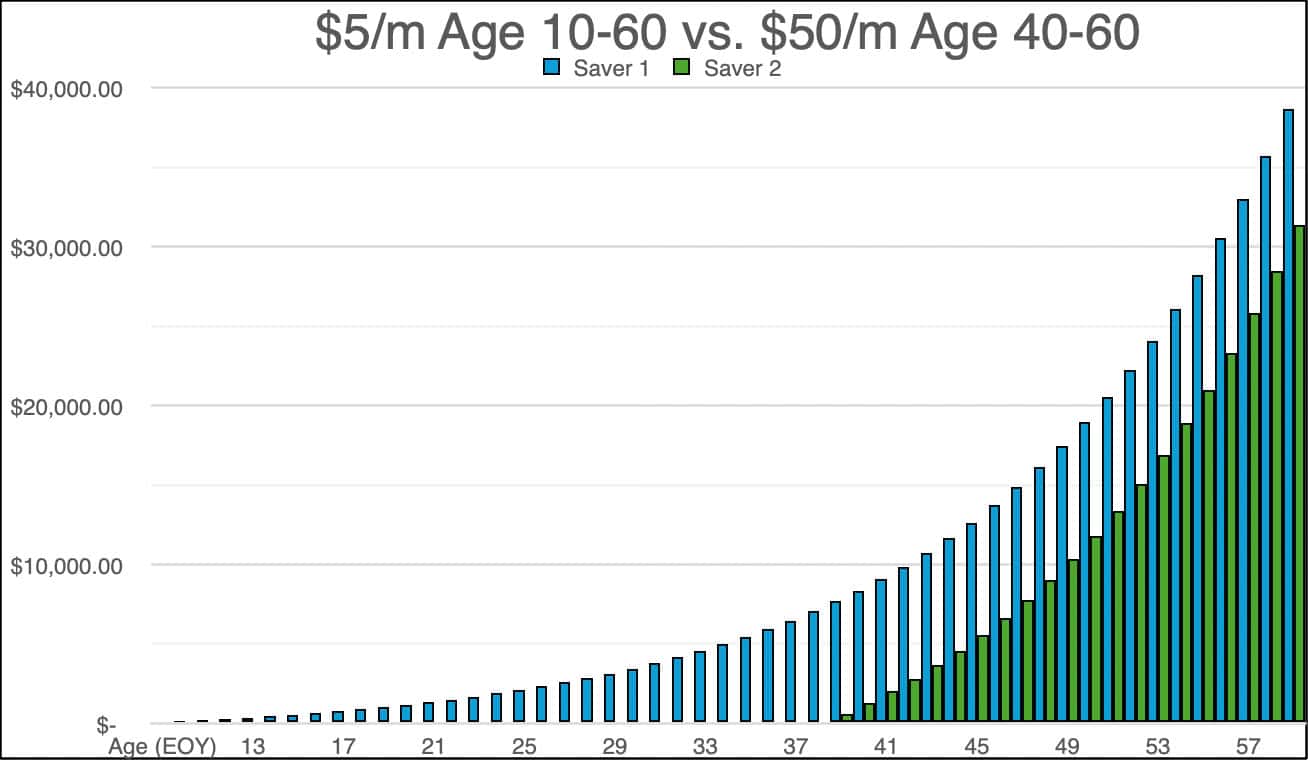

Interest is the money that your savings earns over time. Let’s say you begin saving $5 a month at 10 years old until you turn 60. Your friend decides that when they turn 40, they’ll begin saving $50 a month until age 60. Who do you think will have more money when they turn 60 if they earn 8% annually on their savings?

As can be seen from the above, the saver putting away $5/m from age 10 to age 60 is better off than the individual saving $50/m from age 40-60. In fact, Saver 1 reaches age 61 with $7,248.55 more than Saver 2.

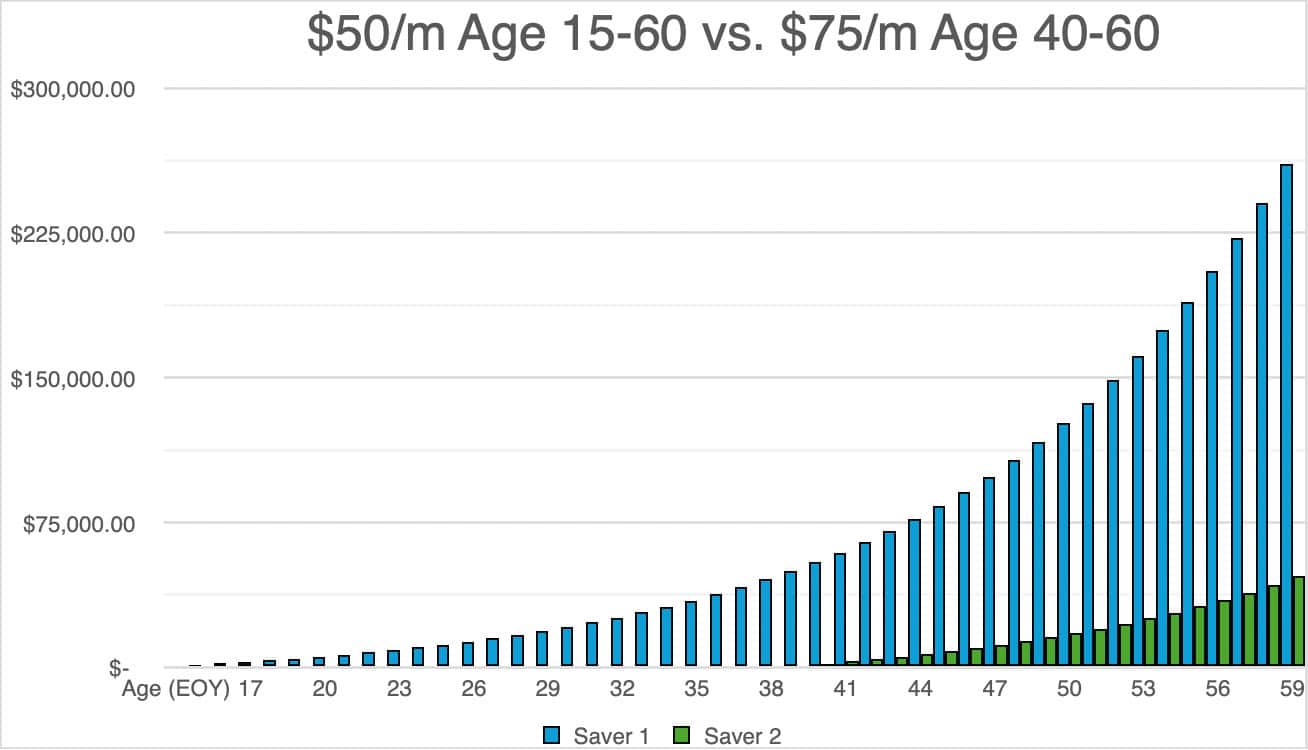

The advantage of saving a little early, rather than a lot later in life, is even more pronounced if we compare $50 per month in savings from ages 15-60 to saving $75 per month from ages 40-60, still using an 8% return:

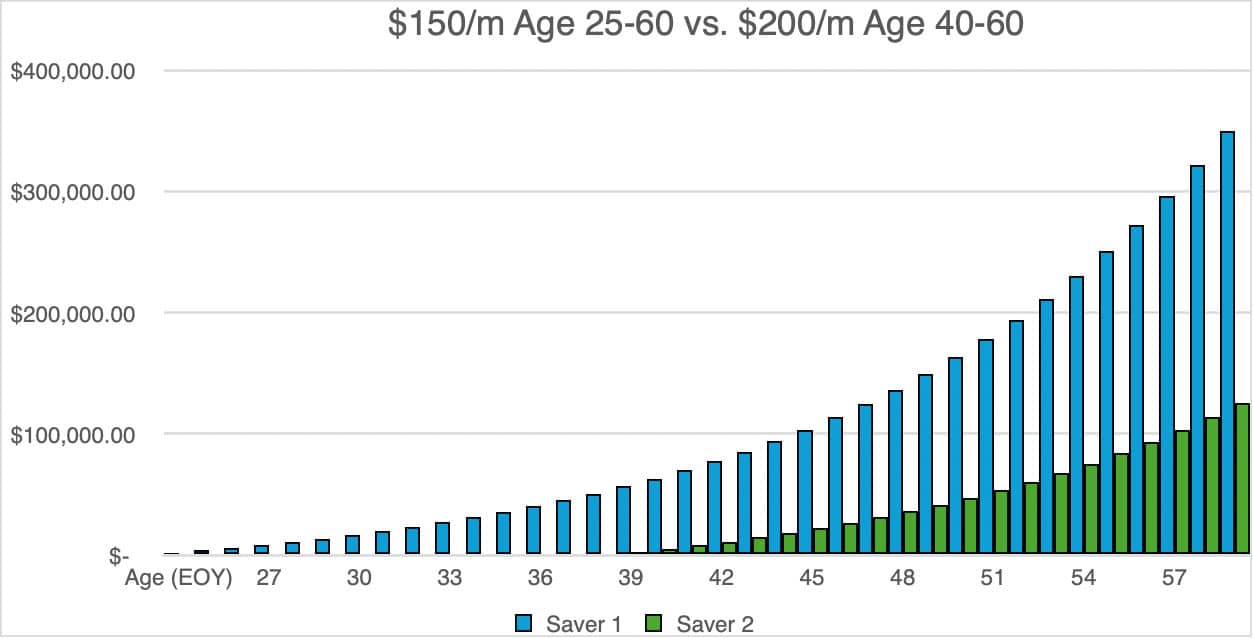

This time Saver 1 turns 61 with $213,387.83 more than Saver 2. To further drive home the point, the below chart shows a comparison of saving $150/m from age 25-60 versus saving $200/m from age 40-60 at an 8% return:

While increasing your savings contributions results in more wealth down the road, there is no substitute for time in the market. This is why beginning early is so important for long-term success.

Here are a few tips on how to explain these ideas to kids:

- Start with Simple Concepts: Begin with the idea of saving. Use a physical piggy bank or a digital savings account to show how money grows over time. Explain that saving a portion of any money they receive, whether from allowances, gifts, or chores, is a way to prepare for future needs or desires.

- Set Goals: Children are more likely to embrace saving if there’s a tangible outcome. Help them set specific, short-term goals–like saving for a toy or a trip. This allows them to see the reward of delayed gratification. Once they achieve a small goal, they’ll better understand the benefits of consistent saving.

- Lead by Example: Children learn by watching their parents. Demonstrate your own saving and investing habits, whether through discussions about budgeting or sharing the family’s financial goals. When children see responsible money management in action, it normalizes the behavior.

- Use Tools and Resources: There are many child-friendly apps and books designed to teach financial literacy. These can make learning fun and interactive. Additionally, as children grow older, you might consider opening a custodial account for them to begin learning about real investments, like stocks or bonds, in a guided way.

- Encourage Questions and Discussions: Create an open environment where financial topics are discussed regularly. Answer their questions and encourage curiosity. This fosters confidence in managing money and reduces the mystery surrounding finances.

- Introduce the Concept of Investing: Once they grasp saving, talk about investing in a simplified way. Explain that investing allows their money to work for them by growing over time, often at a faster pace than savings. Consider using a story or analogy, like planting a seed that grows into a tree, to illustrate the long-term benefits of patience and compounded growth.

Often metaphors and comparisons are more illuminating for children than simply laying out all the information. For instance, saving is like planting a garden; from tiny seeds beautiful flowers and fruit will grow. The most important thing a plant needs to grow is time. No matter how much sunshine, water, and fertilizer the plant has, it still takes weeks, months, or even years to blossom.

Money works the same way. Sometimes it will grow fast, and sometimes it will grow slow, but over time savings will take root and flourish. That is why it is important to start planting the seeds of savings early. As your plants grow, they create their own seeds to add to your garden. In the same way, your savings will grow and create more savings. By having discussions like these, parents can give their children a strong financial literacy foundation, equipping them to be able to make smart financial choices in the future.