The quality of the stocks in your portfolio plays a crucial role in how well your investments recover from market downturns and continue to grow over time. In turbulent markets, quality stocks – those with strong fundamentals, reliable earnings, and solid cash flows – tend to hold up better than lower-quality stocks. This not only mitigates the impact of a bear market but also accelerates recovery times and maximizes the long-term power of compounding.

Faster Recovery from Down Markets

One of the primary reasons quality stocks are so essential in a portfolio is their ability to rebound more quickly after market declines. During down markets, investors often flee to safety, prioritizing companies with solid balance sheets, consistent profitability, and strong competitive positions. These stocks, though they may decline alongside the broader market, often experience less severe drops than speculative or highly leveraged businesses.

For example, during the 2008 financial crisis, high-quality companies like Coca-Cola and Johnson & Johnson declined but maintained relatively stable earnings and recovered quickly once market confidence returned. Compare this to lower-quality financial stocks or companies burdened by debt, which took much longer to bounce back, if at all. The key to faster recovery lies in the strength of a company’s fundamentals – investors regain confidence in quality stocks more quickly, which drives their price back up sooner.

The faster your portfolio recovers, the sooner your investments can resume growing, leveraging the power of compounding. The COVID-19 crash in 2020 offers another example. While the entire market dropped sharply, high-quality tech companies like Apple and Microsoft bounced back within months, while many low-quality stocks struggled to recover for years.

Impact on Compounding and Long-Term Growth

Compounding – the process of earning returns on both your initial investment and the returns it generates – thrives in a stable, upward-trending market. However, significant drawdowns in a portfolio can interrupt this process, forcing an investor to recoup losses before compounding can resume. Quality stocks mitigate these interruptions by minimizing the extent of losses in the first place.

Consider a hypothetical portfolio of quality stocks – let’s say Microsoft, Procter & Gamble, and Visa – during a down market. These companies, known for their strong free cash flow and dominant positions in their industries, may experience a market drop of 15-20%, while lower-quality companies in more volatile sectors could decline by 40-50%. When the market begins to recover, quality stocks tend to rebound faster, allowing the portfolio to resume growth more quickly, thus minimizing the compounding “downtime.”

To illustrate this: assume a portfolio of quality stocks sees a 20% decline in a bear market, and it requires a 25% gain to return to its original value. In contrast, a portfolio of lower-quality stocks might drop by 50%, requiring a 100% gain just to break even. By owning quality stocks, the investor is back on the path to growth much sooner, allowing compounding to take hold earlier and more effectively.

Why Quality Matters for Long-Term Wealth

Over long time horizons, owning quality stocks becomes even more crucial. A portfolio filled with companies that consistently generate profits, reinvest those profits wisely, and maintain financial discipline will outpace a portfolio of speculative or poorly run businesses. This consistent, dependable growth compounds year after year, and the benefits of this compounding become more significant as time goes on.

Quality stocks also tend to offer consistent dividends, which can be reinvested to fuel further compounding. Over the course of several decades, the compounding effect of dividend reinvestment can substantially boost total returns. Companies like Johnson & Johnson, PepsiCo, and 3M have long histories of paying dividends, even during tough economic times, making them pillars of stability in a well-constructed portfolio.

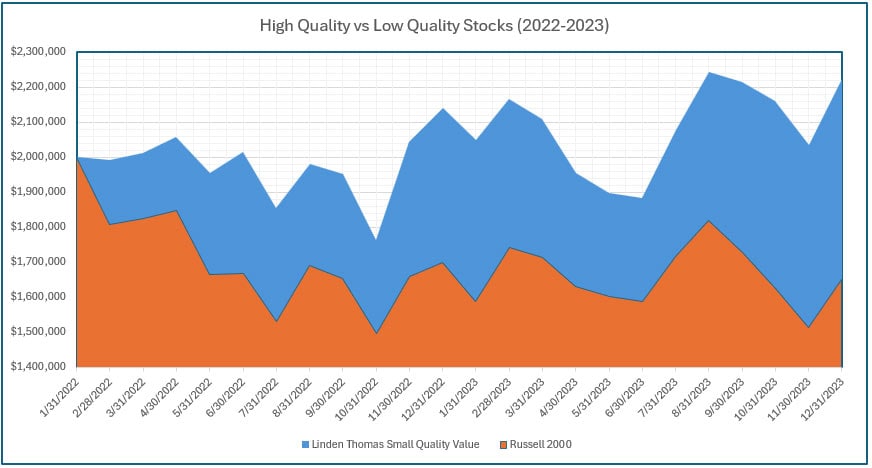

In the example below, a quality-oriented index, the Linden Thomas Small Quality Value fund is plotted against the broader Russell 2000 index during a well-known period of market turbulence, 2022 and 2023. It is evident that, during this time period, the quality index significantly outpaced that broader index. For a theoretical $2,000,000 portfolio, the excess performance equates to a difference of over $625,000!

Exhibit 1 (Source: Zephyr. An index is unmanaged, and you cannot directly invest in an index. Past performance is no guarantee of future results.)

Conclusion: The Case for Quality in Recovery and Growth

Ultimately, the quality of the stocks in your portfolio directly impacts how well your investments recover from downturns, how quickly you restore your compounding, and return to growth. Owning a portfolio of high-quality stocks allows you to minimize losses during market turbulence, speed up recovery times, and maximize the long-term effects of compounding. While no investment is immune to market volatility, focusing on quality helps insulate your portfolio and keeps you on track to achieve your long-term financial goals.