If index investors scan the universe of index funds, what they will find is that there are over 1,700 index funds and more than 3,000 ETFs available. While this may seem like a huge number—and can make it challenging to find an index fund that meets your needs when it comes to results and risk—it is clear that not all indexes are created equal.

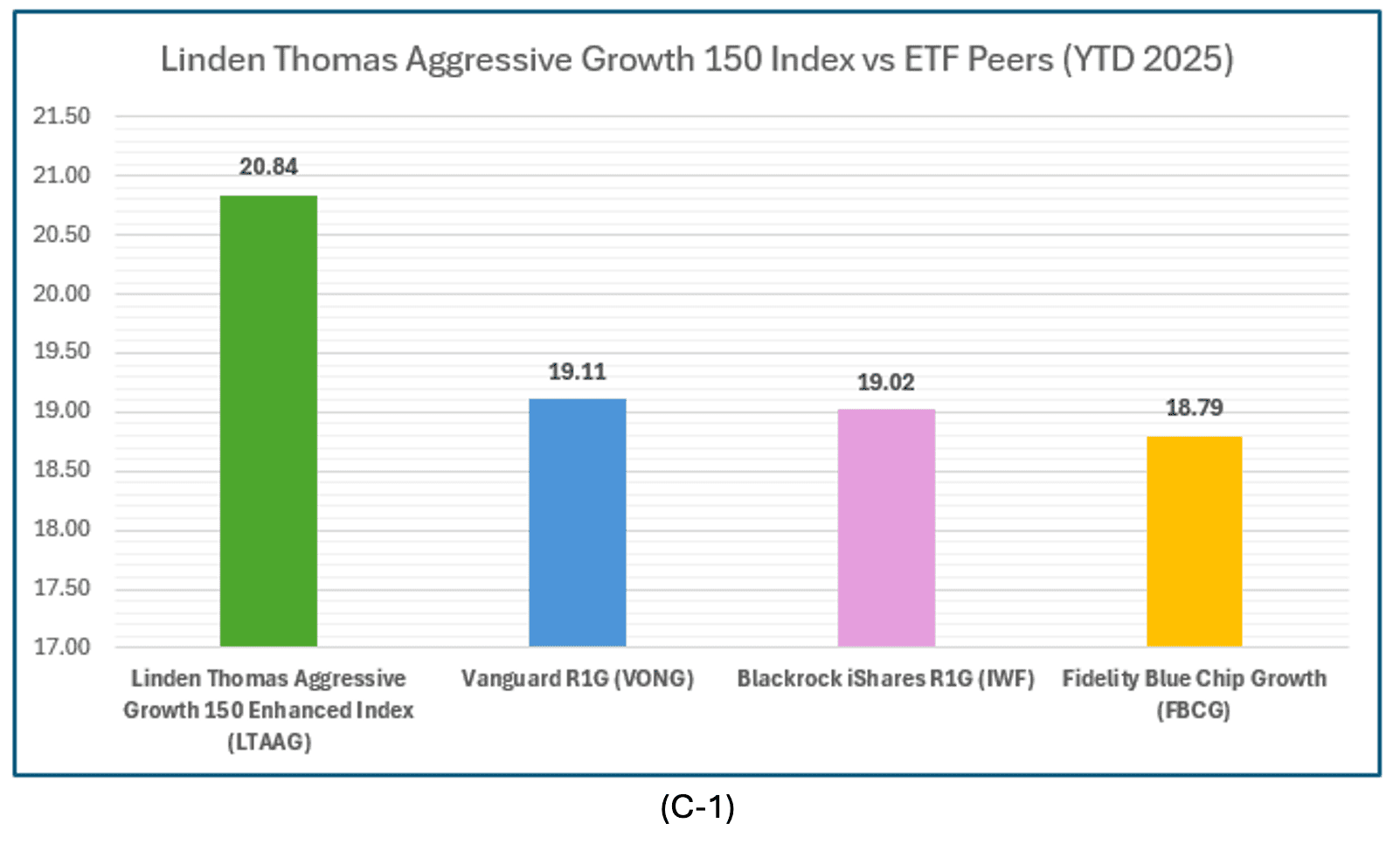

Let’s take, for example, four index investment companies: three that are mainstream and one that is not. The three mainstream investment fund companies are BlackRock—the largest fund company in the world—followed closely by Vanguard and Fidelity. With billions invested in these companies and millions of investors, one might think size should translate into the best results.

One reason these three fund companies have seen such success and growth of assets under management is that retail investment advisors across the country use these funds to build “models” for investors. The benefit to investors is ease and recognition. At the core of these indexes is a tilt toward large companies—commonly known as a market-cap weighted. Essentially, the larger the company, the larger the weight in the allocation.

While the market-cap approach has proven to be valuable, and while the number of market-cap indexes is vast, one lesser-known index company is also drawing attention from affluent investors across the country: Linden Thomas & Co. With over 18 indexes and three ETFs (through its sister firm, Indexperts) launched in 2025, Linden Thomas & Co. and its team of index analysts have been busy building privately managed institutional indexes for affluent and accredited investors who seek a more tailored approach to indexing.

While many of the nation’s largest index funds—like BlackRock, Fidelity, and Vanguard—may be viable options for investors with smaller balances, Linden Thomas & Co. indexes differ in a few meaningful ways. They move from a pooled-fund approach, where investors don’t own the stocks directly, to direct ownership. And while traditional index fund companies may focus on the number of holdings and market-cap requirements, with less regard for the quality of those holdings, the LT&Co. index approach applies earnings-quality screens to identify companies that meet fundamental standards, helping screen out companies with chronically poor earnings.

While returns may differ slightly, what has become a major draw for LT&Co. index investors is that stocks within the portfolio are held directly. This gives investors complete transparency, the ability to conduct tax-loss harvesting, and the ability to gift appreciated holdings. Simply put, in index funds like BlackRock, Fidelity, and Vanguard, investors own a share of the fund, while Linden Thomas & Co. investors own the 150 individual stocks within the portfolio—giving them the full benefit of direct ownership.

Looking ahead, for investors seeking long-term results, large index fund companies will almost always be a good option for those with smaller balances who want to invest in several funds with modest amounts of capital. However, as investors’ values grow and the need for tailoring becomes more important, institutional indexing through lesser-known companies like Linden Thomas & Co. is increasingly attracting affluent investors.