When the stock market drops 10%, do you stop brushing your teeth, stop turning your lights on when you get home, or stop taking showers? When headlines scream “market crash,” do you stop washing your clothes, driving to work, or using your cell phone?

Of course not. Life goes on. Yet, when it comes to investing, many people hit the brakes the moment markets dip. They stop contributing, pull out of long-term strategies, and turn their focus from opportunity to anxiety. But here’s the question: if the companies behind the products and services you rely on every day haven’t disappeared, why should your belief in owning a piece of them?

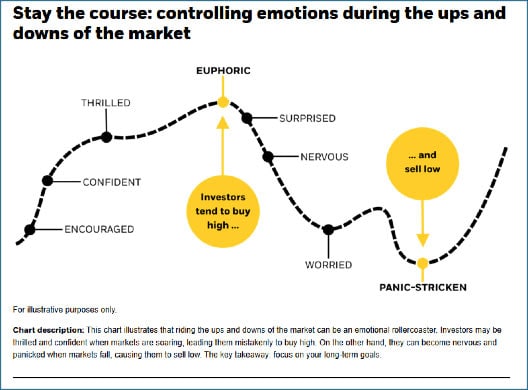

Every market downturn arrives with a new cast of characters and a fresh set of fears: rising interest rates, inflation, geopolitical tensions, tech crashes, or even pandemics. The headlines change, but the core story often doesn’t. Markets despise uncertainty. When faced with it, they often overreact–not to what is happening today, but to what might happen tomorrow. In these moments of heightened volatility, media coverage tends to pour fuel on the fire, amplifying investor anxiety. As confidence erodes, many investors flee to perceived “safe havens,” abandoning depressed quality equities in search of short-term security. But more often than not, these emotionally driven exits come at the worst possible time – when the market is already oversold. Ironically, it’s during the darkest headlines that markets often begin to recover, rallying not after the bad news is over, but during it. Meanwhile, the media – usually behind the curve, because the media reports on what HAS happened, not what WILL happen – shifts its tone, praising the comeback. This draws reluctant investors back in, only to find they’re buying the same assets they sold–at higher prices. This cycle of fear, flight, regret, and reentry isn’t new. In fact, it’s a well-documented behavioral pattern that, left unchecked, can do more damage to long-term portfolios than any single downturn. Even the best-designed investment plans can be undone by poor investor behavior.

Understanding this behavioral pattern is key to becoming a more resilient investor. Rather than chasing headlines or reacting to the latest crisis, successful investors learn to recognize that the emotional roller coaster is part of the process-and that markets have a long history of recovering, adapting, and growing over time. The real challenge isn’t just surviving downturns – it’s resisting the noise and temptation to abandon a long-term balanced strategy for short-term relief.

1. The Market Hates Uncertainty (and it shows!)

Markets are efficient in the long term but can be wildly emotional in the short term – especially in the face of uncertainty. Whether it’s a geopolitical event, an interest rate hike, or a global pandemic, the initial market reaction is almost always exaggerated. Fear spikes. Volatility rises. And investors get caught in the crossfire of headlines and uncertainty.

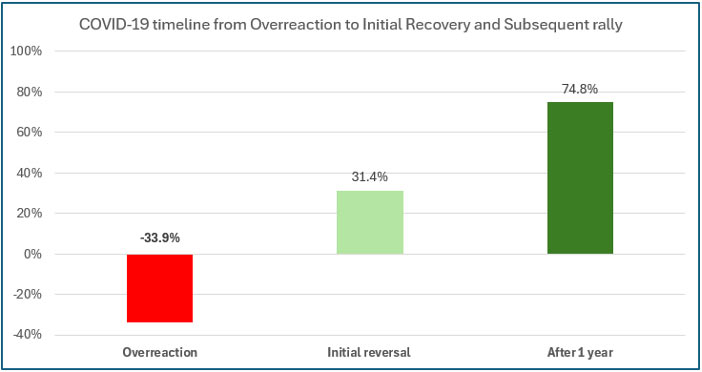

Exhibit 1 (Source: Factset)

As you can see from the example above, one striking case was COVID-19. Between February 18 and March 24, 2020, the market dropped by nearly 34% following news of the first few cases hitting the U.S. The sell-off intensified as media coverage added fuel to the fire, sparking fear among individual investors. This illustrates just how powerful media influence can be during periods of uncertainty.

Yet, despite worsening case counts and rising deaths throughout the year, the market rallied back sharply, initially rising over 30% and ultimately soaring by 75% by the end of the one-year anniversary. This rebound wasn’t led by small investors – it was driven by institutional investors, who ultimately move the markets. Unfortunately, many individual investors were swept up in the panic, caught between institutional flows and sensational media narratives.

2. The Media Adds Fuel to the Fire

In uncertain times, the media has a job to do: keep you watching, clicking, and coming back for more. And that often means sensationalizing the bad news. “This Time It’s Different” or “The Death of Equities” grab attention, but rarely reflect the full reality. Media noise grows louder when the market is under pressure-not necessarily because the news is getting worse, but because the story must evolve to keep us engaged.

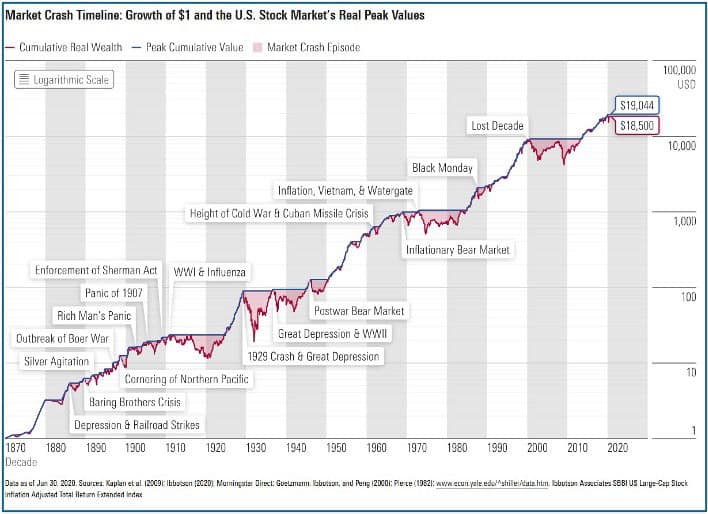

3. From Long – Term Thinking to Short – Term Panic

When markets dip and the media’s volume rises, it’s easy for investors to lose perspective. Instead of staying focused on long-term goals, attention shifts to short-term damage control. Portfolios are no longer seen as collections of long-term ownership in great businesses, but as balances to be protected. Investors go from being owners to principal watchers.

Exhibit 2 (Sources: Kaplan et al. (2009); Ibbotson (2020); Morningstar Direct; Goetzman, Ibbotson and Peng (2000); Pierce (1982) )

4. The Turnaround (That Many Miss)

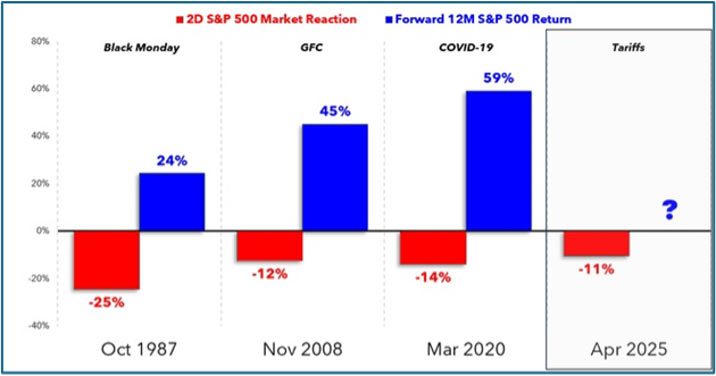

Eventually, markets recover. And they often do so before the headlines turn positive. Markets tend to trade in anticipation of better conditions – long before the economy catches up or the media turns optimistic. In fact, the biggest gains often happen in the early stages of recovery, while fear is still in the air. Those who sold in fear? They’re still on the sidelines! The chart below (Exhibit 3) shows the 12-month rebound in the stock market after a large 2-day downturn. As you can see, after each of these well-known crashes, the market rallied back in a big way!

Exhibit 3 (Source: Matt Ceramino, Past performance is not a guarantee of future results)

5. FOMO Replaces Fear

As markets rebound, so does confidence. The same investors who sold in fear start to feel like they’re missing out. The media begins to ask, “Is the worst behind us?” And the answer, often, is yes – because the rebound has already occurred. Investors buy back in, but at higher prices than where they sold. It’s the ultimate whipsaw.

6. The Cycle Repeats

A few years pass. The markets go up. Confidence grows. Investors start chasing returns they believe they missed. Investors tilt more aggressively. Caution fades. Then another headline, another downturn. The pattern repeats. Behavior – not the market – is often the real source of portfolio underperformance.

Exhibit 4 (Source New York Life Investments, 2020)

So, What’s the Lesson?

To fix an old-school problem – poor investment behavior – we must first recognize a critical truth: while each down market may come with a different headline, the outcome for many investors is often the same. The cycle typically begins with uncertainty, followed by market overreactions, followed by sensational media coverage. This fuels investor anxiety, prompting individuals to shift their focus from long-term strategy to short-term fear. As confidence wanes, many sell at the worst possible moment – locking in losses just before markets begin to recover. Institutional investors, unfazed by the noise, return first, driving prices higher. The media then reverses its tone, small investors rush back in, and the damage is already done. Breaking this destructive cycle requires a mindset shift. Instead of seeing down markets as threats, investors must learn to see them as opportunities – moments to accumulate shares at a discount, stay disciplined, and embrace long-term planning. That’s how you move from reactionary to resilient, from emotional to effective – and how you write a new chapter of better behavior and stronger results. Remember, the key to building wealth is to construct a quality portfolio, with direct ownership, spreading risk between sectors and then give it time!

“Time in the market is more important than timing the market!” – Stephen L. Thomas