Index investing has gained significant popularity among investors seeking a passive approach to wealth accumulation. It offers broad market exposure and is known for its potential to deliver consistent returns over the long term. While traditional index investing through pooled funds like mutual funds and exchange-traded funds (ETFs) remains a popular choice, institutional direct indexing with individual securities has emerged as an alternative. Let’s compare these two approaches to help investors make an informed decision.

1. Diversification:

Pooled Funds: Mutual funds and ETFs provide instant diversification by holding a basket of securities that replicate an index. This diversification helps mitigate the impact of individual stock performance on the overall portfolio.

Institutional Direct: Direct indexing allows investors to build a portfolio using individual securities to replicate an index. While it offers greater transparency and control over the selection of specific stocks, it usually requires higher minimum investments, making it more appropriate for institutional and affluent investors.

2. Costs:

Pooled Funds: Mutual funds and ETFs charge expense ratios, which represent the fund’s management fees and operational costs. However, investors should be aware of additional costs, such as internal trading costs, trade spreads, cash drag, lack of quality, phantom taxes, price disadvantages, bond ETF discounts to NAV, and RIA advisor fees.

Institutional Direct: Direct indexing avoids the expense ratios, internal trading costs, cash drag, phantom taxes, price disadvantages, and ETF discounts to NAV found in pooled funds. Direct indexing is typically more cost-effective for larger portfolios.

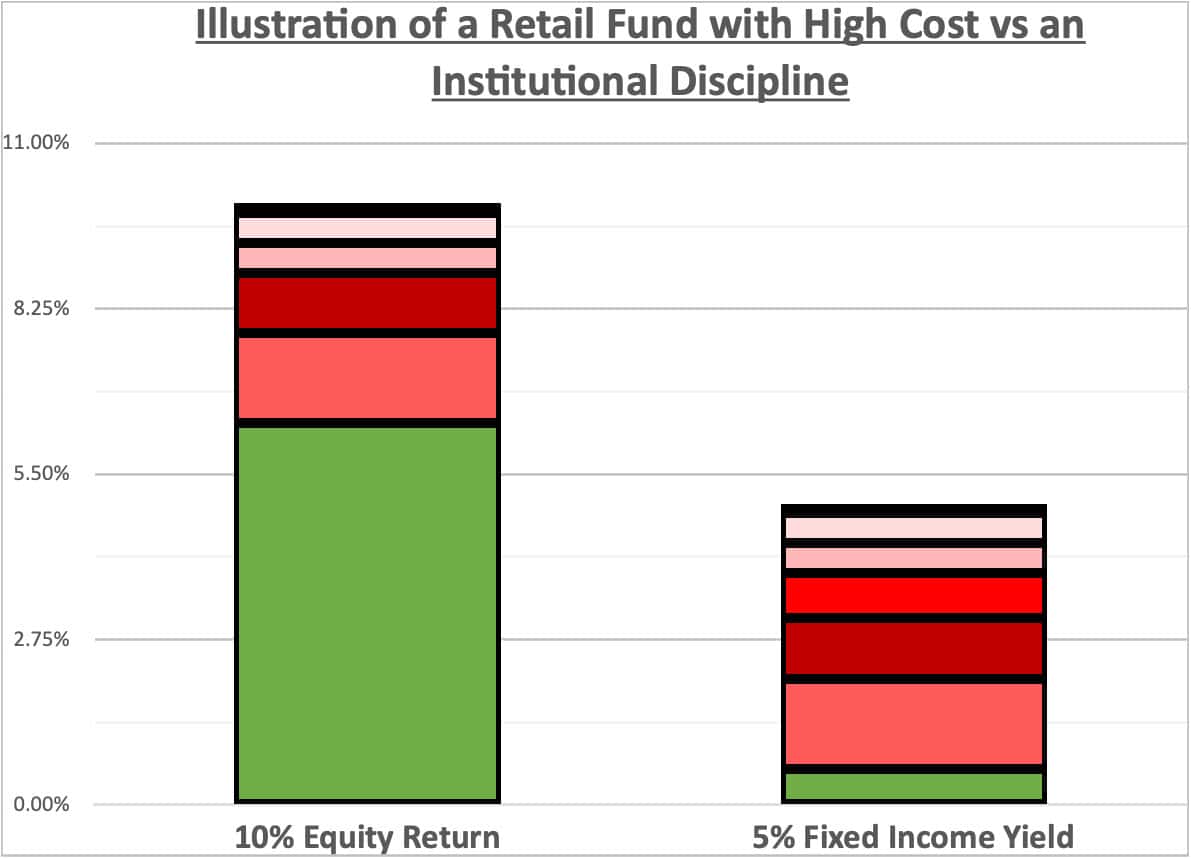

The below graph shows how the layers of costs for a retail mutual fund or ETF can significantly erode returns to the investor:

*Fees and cost are hypothetical and not reflective of any specific cost associated with a particular fund

A brief explanation of these costs can be found below:

- RIA Advisor Fee – Advisors charge a fee for asset allocation or portfolio construction, but simply invest their clients into mutual funds or ETFs that the advisor has no part in constructing or managing. This effectively means the investor is paying two levels of fees on the same assets.

- Internal Trading Costs – Also known as turnover costs, these expenses arise from the buying and selling of securities within a pooled fund’s portfolio. Mutual funds and ETFs with higher turnover ratios have higher internal trading fees, as more frequent buying and selling of securities leads to increased transaction costs.

- Spreads on Trades – The spread is the difference between the bid price (the price at which someone is willing to buy a security) and the ask price (the price at which someone is willing to sell a security). The fund may be selling assets for less than an individual investor would, and buying assets for more than an individual investor would, due to the typically large size of each trade. The result is a drag on the fund’s performance.

- Pricing Disadvantages – Mutual funds can buy into bonds that are priced at a premium or discount. This can create pricing disadvantages when investors buy shares of the fund. If the pooled fund holds bonds trading at a premium, investors effectively pay more for the bonds than their face value. Conversely, bonds trading at a discount may lead to lower yields for investors.

- Fund Fees – Also known as expense ratios, these cover costs for a pooled fund’s portfolio management, administrative costs, marketing expenses, legal fees, custodial services, and other operational overhead. Essentially, the expense ratio covers the costs of running the pooled fund and is deducted directly from the fund’s assets. The expense ratio is expressed as a percentage of the net asset value and is available for all public pooled funds.

- Herding Impact – As small investors move into and out of the pooled fund every day, it creates more costs as positions may be sold to fund redemptions. Oftentimes, this leaves fund managers hostage to small investor behavior, requiring them to maintain a stockpile of cash to fund the redemptions. This cash earns very little return but is still subject to the expense ratio and other pooled investment costs.

3. Control and Transparency

Institutional Direct: Unlike pooled mutual funds, direct indexing gives affluent investors total control and total transparency, allowing them to make the choices that best meet their needs. With direct ownership investors retain the ability to harvest tax losses or gift appreciated shares, allowing for more flexible and efficient tax management.

4. Ownership

Pooled Funds: Assets are pooled with other investors and managed by a third-party. Every investor in the fund has different needs, risks, and concerns. Some investors have discipline, but many don’t. This makes investors vulnerable to small investor herding impacts.

Institutional Direct: Each portfolio is built through individual stocks, not through funds that are pooled with other investors. This allows each of our clients to have total control over their holdings while not being subject to small investor herding.

5. Investor Behavior

Pooled Funds: Pooled ownership means that all investors are subject to small investors’ bad investment behavior. When markets decline, history has shown that small investors often sell in a panic. This forces fund companies to sell when they should hold their positions or add to weak positions during the down-market. Other investors’ behavior can exacerbate the impacts of internal trade costs and trade spreads in pooled products.

Institutional Direct: Indexing with individual equities means that investors are not hostages to small investors’ bad behavior. With direct indexing, investors can take advantage of down-markets by adding to specific positions at lower prices. Rather than being “along for the ride” with other investors, institutional direct investors can take advantage of the low prices market downturns create.

6. Customization

Institutional Direct: Direct indexing provides a higher degree of customization. Investors can tailor their portfolios by excluding specific stocks, incorporating personal preferences, or incorporating environmental, social, and governance (ESG) criteria. This level of customization can align the portfolio more closely with an investor’s goals and values.

7. Tax Efficiency

Pooled Funds: Mutual funds and ETFs distribute capital gains to their shareholders, which can create tax liabilities, even for investors who haven’t sold their fund shares. Additionally, investors have no control over the timing of these distributions, potentially leading to higher tax bills.

- For example, imagine an investor buys into a fund on Monday. On Tuesday, the fund’s value drops by 20%. Many small investors redeem their shares, forcing the fund to liquidate assets. If some of the positions sold to meet these redemptions have gained value since the fund purchased them (which may have been several years ago), then the fund investors will incur a capital gain. This means the investor may owe taxes, even though their overall investment is down 20%.

Institutional Direct: Direct indexing offers enhanced tax efficiency. Investors can selectively harvest tax losses by selling individual securities at a loss, offsetting gains in other parts of their portfolio. They can also select specific securities to gift. By gifting highly appreciated securities, investors can better manage their capital gain distributions. This flexibility can result in reduced capital gains taxes and increased after-tax returns.

8. Minimum Investment

Pooled Funds: Mutual funds and ETFs typically have minimum investment requirements, which can vary depending on the fund and share class but are generally relatively low.

Institutional Direct: Direct Indexing usually requires a larger initial investment to achieve a diversified portfolio. Investors with the necessary capital should consider direct indexing because of the increased flexibility and efficiency.

Pooled funds provide instant diversification and simplicity, making them suitable for most investors. On the other hand, institutional direct indexing offers customization, potential tax advantages, and the ability to align investments with personal values. It is more suitable for investors with larger portfolios who seek greater control. Ultimately, the choice between these two approaches depends on an individual investor’s goals, preferences, and circumstances.