Investing is often viewed as a balancing act, where the goal is to maximize returns while minimizing risk. However, the market is a dynamic place, and no single asset class consistently delivers the best results year after year. That’s why the key to long-term success lies not in trying to time the market or chase returns but in the strategic allocation of assets across different classes that historically perform differently.

Understanding the Inverse Relationships Among Asset Classes

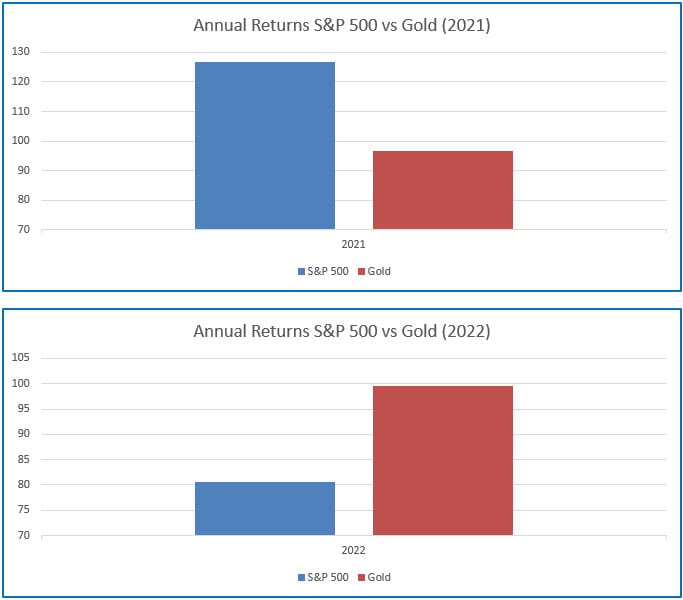

At the heart of diversification is the idea that different asset classes often respond differently to economic and market conditions. When one zigs, the other zags (see Exhibit 1 below). This relationship is most apparent in the historically inverse performance of stocks and bonds. For decades, these two asset classes have shared an almost see-saw relationship: when stocks fall, bonds often rise, and vice versa. This counterbalance is critical in helping to stabilize a portfolio during turbulent times.

Exhibit 1: Annual returns of S&P 500 vs Gold 2021-2022 (Source: Factset)

Another classic example is the relationship between stocks and precious metals like gold. Precious metals have traditionally served as a hedge against stock market volatility and inflation. When stock markets experience significant declines, investors often flock to gold and other safe-haven assets, driving their prices up. This pattern underscores the importance of holding assets that can perform well in different economic environments.

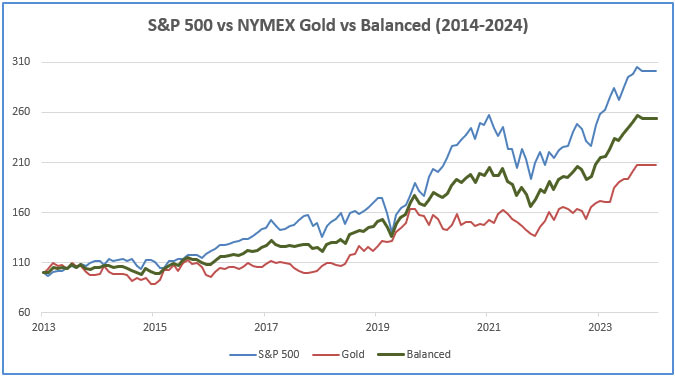

Exhibit 2: S&P 500 vs NYMEX Gold vs Balanced (50/50) (2014-2024) Source: Factset

Example 1: The 2008 Financial Crisis

One of the most striking examples of the benefits of diversification occurred during the 2008 financial crisis. As the housing bubble burst, stock markets around the world plummeted. The S&P 500 lost nearly 37% of its value, erasing trillions of dollars from retirement accounts and causing widespread panic among investors. However, while stocks were tanking, U.S. Treasuries and gold prices soared. U.S. Treasuries were up around 20% as investors sought the safety of government bonds, and gold climbed by roughly 5% for the year, providing a valuable cushion for portfolios that included these assets.

For investors who had over-allocated to stocks, the paper losses were substantial. On the other hand, those who held a diversified mix of stocks, bonds, and gold likely experienced a much less severe decline. This highlights the importance of not putting all your eggs in one basket.

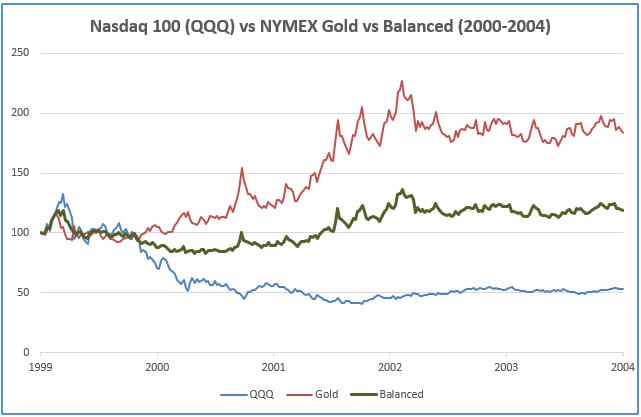

Example 2: The Dot-Com Bust of 2000-2002

The early 2000s provided another clear example of how diversification can protect a portfolio. During the Dot-Com bust, tech-heavy stock indices like the NASDAQ Composite lost nearly 80% of their value from peak to trough between 2000 and 2002. Investors who were overexposed to tech stocks saw their portfolios decimated. However, bonds–particularly high-quality government bonds–performed well during this period. The Barclays U.S. Aggregate Bond Index, for example, posted positive returns in each of those three years, as investors sought safety in fixed-income securities amid the stock market collapse.

For diversified investors, the strong performance of bonds during this period provided a counterweight to the steep declines in stocks, reducing overall portfolio volatility and mitigating losses. Adding an uncorrelated asset class to a typical stock portfolio, especially during the volatile period following the Dot Com bust, provided a significant cushion to prepared investors.

Exhibit 3: Nasdaq 100 (QQQ) vs NYMEX Gold vs Balanced (50/50) (2000-2004) Source: Factset

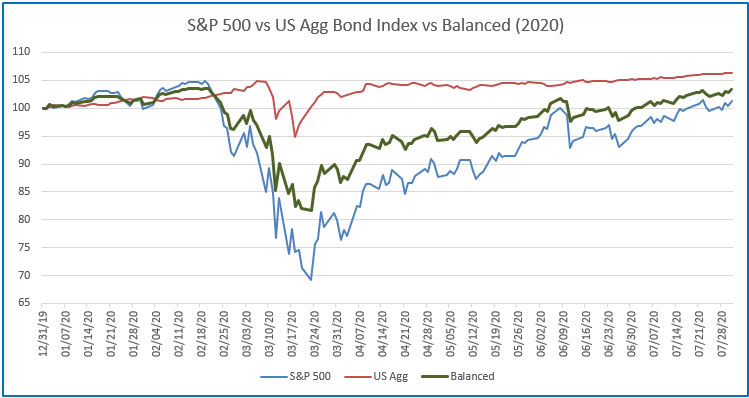

Example 3: The COVID-19 Pandemic

In March 2020, the world was plunged into uncertainty as the COVID-19 pandemic spread rapidly, triggering one of the sharpest market downturns in history. The S&P 500 fell over 30% in a matter of weeks, wiping out three years of gains. However, once again, the power of diversification came into play. While stocks were crashing, U.S. Treasuries surged, with the 10-year Treasury yield dropping to record lows and bond prices rising significantly. Gold also spiked as investors scrambled for safety, rising over 25% by mid-2020.

Those who had a well-diversified portfolio that included bonds and gold were able to weather the storm far better than those who were heavily invested in equities alone. This is a prime example of how exposure to multiple asset classes can help protect your wealth during times of extreme volatility. The chart below (Exhibit 4) demonstrates how a balanced portfolio containing a mixture of stocks and bonds weathered the most severe downturn of the COVID-19 pandemic during the first half of 2020.

Exhibit 4: S&P 500 Index vs US Aggregate Bond Index vs Balanced (50/50) (2/20-12/20) Source: Factset

Undiversified Risk: A Dangerous Gamble

The examples above make one thing clear: undiversified risk is rarely rewarded over the long term. Investors who concentrate their portfolios in a single asset class, whether it’s stocks, bonds, or anything else, are essentially gambling that the economic and market conditions will consistently favor that asset. History shows us that this can be a risky bet.

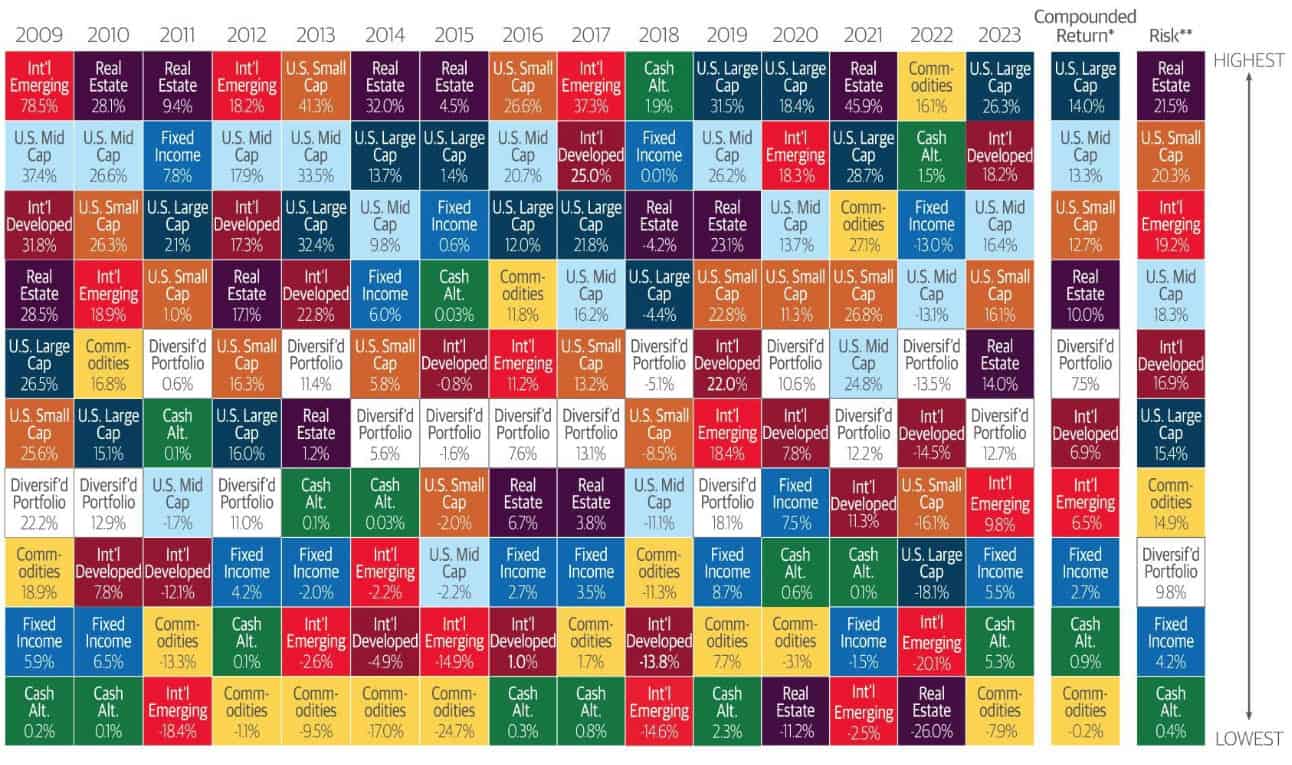

Oftentimes, the best performing sector in one year becomes the worst performing sector the next year. Take, for example, the case of Emerging Market stocks. In 2009 this was the top-performing segment of the asset class (+78.5%). Then, just 2 years later in 2011, Emerging Markets turned in one of their worst years (-18.4%).

Exhibit 5: Historical results of various investment sectors Source: Northwestern Mutual

A Practical Approach to Diversification

For affluent investors, the goal should be to build a portfolio that balances risk and return across a range of asset classes. While the exact mix will depend on individual goals, risk tolerance, and time horizon, a well-diversified portfolio might include:

- Equities: Representing growth potential.

- Bonds: Offering income and stability.

- Precious Metals: Acting as a hedge against inflation and market turmoil.

- Real Estate: Providing income and diversification beyond traditional asset classes.

- Commodities: Offering protection in inflationary environments.

By diversifying across these and other asset classes, you can reduce the impact of any single asset’s poor performance on your overall portfolio. This doesn’t mean you’ll always achieve the highest possible returns in any given year, but it does mean that you’ll be more likely to avoid catastrophic losses and enjoy a smoother, more predictable investment journey.

Conclusion: Diversification is the Ultimate Risk Management Tool

The financial markets are full of uncertainties, and no one can predict with certainty which asset class will lead or lag in the future. However, history teaches us that diversification remains the most effective way to manage risk and enhance the potential for long-term success. By spreading investments across different asset classes, you can benefit from their complementary performance characteristics, reducing volatility and protecting against the inevitable ups and downs of the market.

In a world where undiversified risk is seldom rewarded, a well-diversified portfolio isn’t just a strategy–it’s a necessity. So, if your portfolio isn’t diversified, now is the time to take action. After all, it’s not about timing the market; it’s about time in the market–with a diversified approach that stands the test of time.