Investors face a myriad of challenges, but three primary influences can cloud judgment and derail a well-crafted strategy. This trifecta of negative influences–losing value in a down-market, media sensationalism, and the temptation of short-term better-performing alternatives–often leads to emotional decisions and short-term thinking. Understanding these pitfalls is essential for maintaining a disciplined approach to investing.

1. The Pain of Losing Value in a Down-Market

Loss aversion is a fundamental aspect of investor psychology. Studies have consistently shown that the pain of a loss is felt more acutely than the joy of an equivalent gain. In down-markets, investors often see their portfolios shrink and experience a visceral reaction. This discomfort can drive hasty decisions, such as panic selling, which locks in losses and undermines long-term goals.

When markets are declining, the rational course of action–staying invested or even increasing positions–can feel counterintuitive. However, market downturns have historically been temporary, while staying invested has proven to be a reliable strategy for recovery and growth. Resisting the urge to “cut and run” is essential to avoid sabotaging long-term performance.

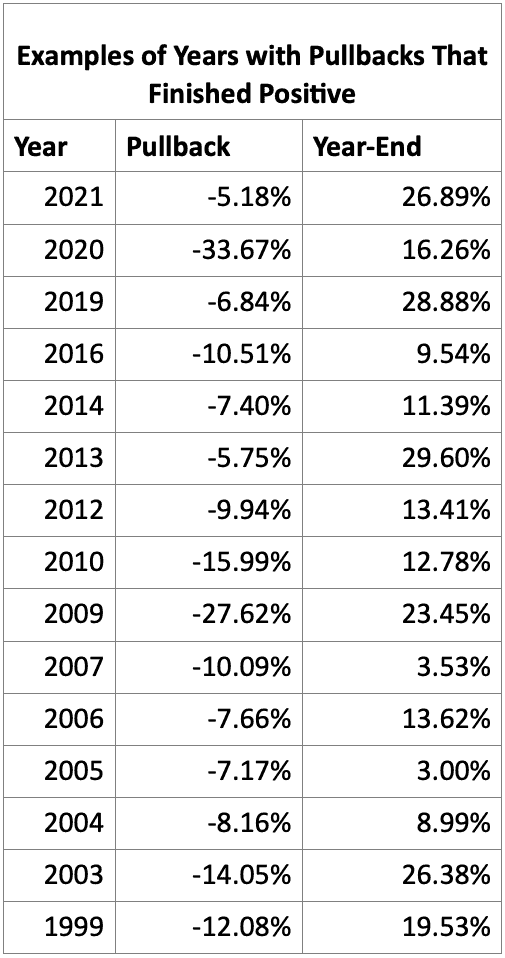

Focus on your long-term investment horizon, and remember that volatility is a natural part of the market cycle. Diversification and disciplined rebalancing can help mitigate risk and provide a sense of control. Remember, while not guaranteed, the market has always recovered in the past! In fact, there are many years where the S&P 500 experienced large pullbacks, only to end up finishing the year in the positive. You can see the myriad examples of this below:

Source: S&P 500

2. Media Sensationalism and the Doom & Gloom Cycle

Media outlets thrive on attention-grabbing headlines, often emphasizing worst-case scenarios or market calamities. In times of uncertainty, the 24/7 news cycle amplifies fear, fostering a sense of imminent catastrophe. While staying informed is crucial, sensationalist media can distort reality and prompt knee-jerk reactions.

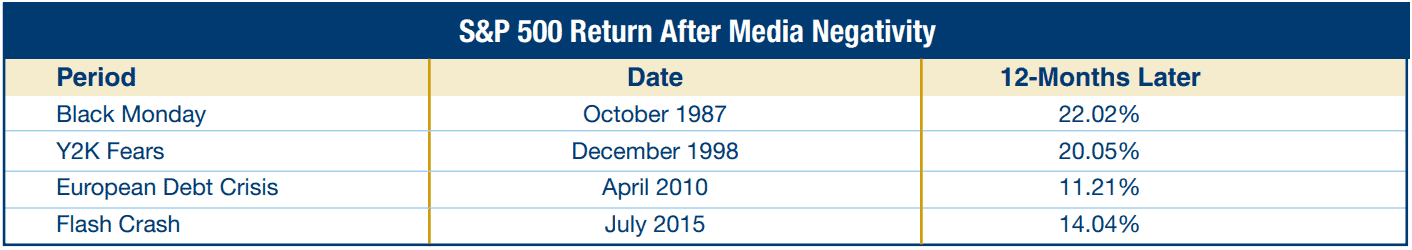

Hyperbolic phrases like “historic collapse” or “market meltdown” can ignite panic, even when the actual market movement is relatively modest. Investors who internalize these narratives may abandon sound strategies in favor of unproductive or risky behavior. History is full of examples where media-driven panic was proven wrong, as can be seen below:

Source: S&P 500

During the 2008 financial crisis, headlines predicted the end of capitalism, but markets began to recover within months. In March 2020, when COVID-19 fears caused markets to plummet, widespread media predictions of long-term devastation were quickly upended by a swift rebound. These examples demonstrate that markets frequently exhibit greater resilience than anticipated, recovering more swiftly than the prevailing sentiment suggests.

Avoid putting too much weight on any news, as it often reflects short-term noise rather than meaningful trends. Most mainstream market news is designed for entertainment or urgency, not for informed decision-making. The media is reporting on current events, and bad news sells. This leads the media to sensationalize events or predicting they will get worse, which can lead to less seasoned investors abandoning their long-term investment plans. What many investors may not realize is that the market often prices-in bad news and results beforehand and often is already recovering when the media says things are at their worst. When building a portfolio, it is wise to consider that the markets have rallies and pullbacks (bulls and bears). Each coin has two sides, and it’s important as an investor to consider both sides of the market.

3. The Grass is Greener Syndrome (FOMO)

In a market filled with diverse asset classes, sectors, and investment strategies, the “fear of missing out” (FOMO) can drive investors to abandon their plans in pursuit of the “next big thing.” In down-markets, this temptation can be even stronger when a specific asset or sector appears to be holding up better than your diversified portfolio. Comparing your balanced portfolio to a short-term outperformer, such as a single asset class or narrowly focused strategy, can create unnecessary frustration.

Chasing these temporary outperformers can result in buying high and selling low–the opposite of prudent investing. A diversified portfolio is designed to weather volatility and deliver long-term growth, not to outperform every short-term rally or pullback. Abandoning this structure could leave you exposed to greater risk and undermine your ability to recover when markets rebound.

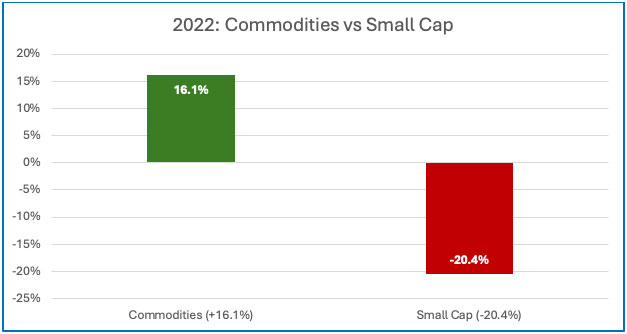

In 2022 an investor may have considered selling their small-cap stocks in favor of commodities:

Commodity: Bloomberg Commodity Index, Small cap: Russell 2000

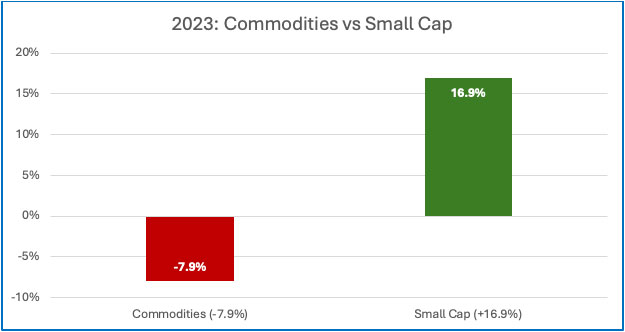

If the investor isn’t careful, they could make a big mistake. The next year’s results looked very different:

Commodity: Bloomberg Commodity Index, Small cap: Russell 2000

Set clear, long-term goals and remind yourself of the rationale behind your investment strategy. Regularly reviewing your progress against your own objectives–not the performance of specific assets that may be temporarily outperforming–can help you stay grounded.

What Can You Do About It?

These three influences–the pain of losses, media hype, and FOMO–are powerful, but they can be managed with self-awareness and discipline. Successful investing requires a steady hand and a commitment to long-term principles, even in the face of discomfort, fear, and temptation.

When you recognize these negative influences for what they are, you can navigate the markets more confidently and avoid costly missteps. Stay patient, stay informed, and stay committed to your investment plan.