Income plays a crucial role in retirement, not only as a source of funds to cover daily expenses but also as a stabilizing factor for the entire retirement portfolio. The ability to generate a steady income can significantly impact the sustainability of your retirement savings, especially during down markets. This article explores the benefits of income in retirement, emphasizing how it protects against negative compounding during market drawdowns and enhances overall financial security.

The Importance of Steady Income in Retirement

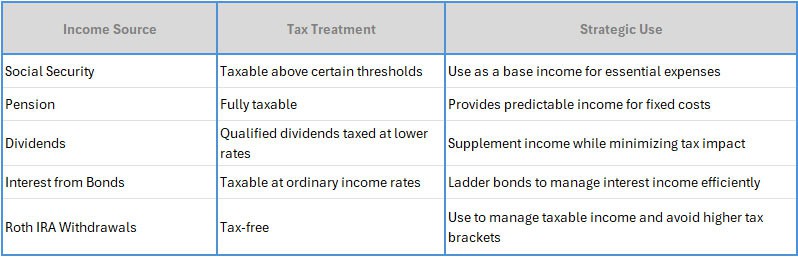

Exhibit 1

A consistent income stream in retirement provides several key benefits:

- Covering Essential Expenses: The primary function of income in retirement is to cover essential living expenses such as housing, healthcare, food, and transportation. Without a reliable income, retirees may have to dip into their savings more frequently, potentially depleting their resources faster than anticipated.

- Reducing Withdrawal Pressure: Having a steady income reduces the need to sell investments at inopportune times. This is particularly beneficial during market downturns, as it allows retirees to avoid locking in losses by selling assets at a lower value.

- Mitigating Early Drawdown Risk: Drawdown risk refers to the potential negative impact of withdrawing funds during a market downturn early in retirement. A consistent income stream can mitigate this risk by providing necessary funds without the need to liquidate investments.

Social Security and Pension Income

Social Security and pensions are two common sources of steady income for retirees. These income streams are typically inflation-adjusted and provide a guaranteed monthly payment. By relying on these sources, retirees can cover a significant portion of their essential expenses without tapping into their investment portfolios.

- Social Security: For many retirees, Social Security represents a significant portion of their retirement income. The benefits are adjusted for inflation, ensuring that purchasing power is maintained over time.

- Pensions: Defined benefit pensions offer a predictable income stream for life, reducing the uncertainty associated with market fluctuations.

Dividend and Interest Income

Investments that generate dividends and interest can provide a reliable source of income. For example, a retiree with a well-diversified portfolio of dividend-paying stocks and bonds can receive regular payments without selling the underlying assets.

- Dividend Stocks: Companies with a history of paying and increasing dividends can offer a steady income stream. During market downturns, these dividends can help cover expenses without the need to sell stocks at a loss.

- Bonds: Fixed-income investments such as bonds provide regular interest payments. Holding a mix of bonds with different maturities can create a laddered income stream that supports cash flow needs.

Let’s look at a real-world example. Let’s assume you have recently retired and have a portfolio worth $3,000,000. You have a 60/40 split with 60% invested in stocks and 40% invested in bonds. You are able to comfortably withdraw $10,000 a month (or $120,000 a year = $3,000,000 * 4%) and still remain at an acceptable distribution rate. But let’s say you actually need $20,000 a month ($240,000 a year). That puts a lot more strain on your portfolio because your investments will now need to earn at least an 8% return each year. Let’s further assume that your bonds are yielding 3% after expenses. That translates into $36,000 a year in interest income. If you and your spouse are also receiving $60,000 a year from Social Security, then your investments must return $180,000 a year ($240,000 – $60,000). Since your bonds are yielding $36,000 that means your stocks will need to generate $144,000 a year ($180,000 – $36,000). So, considering that your portfolio has $1,800,000 in stocks, that means that you will have to earn 8% a year on your stocks in order to hit your $144,000 goal.

Without the inclusion of Social Security ($60,000) or the bond income ($36,000), your stocks would have to earn over 13% each year ($240,000 / $1,800,000). That’s a much more challenging hurdle. Since the long-term average annual return of stocks is just north of 8%, a target of 13% would require heroic efforts (and likely a lot of luck!)

What happens if stocks go into a down market, such as the one we experienced in 2008 during the Great Financial Crisis? Suppose the value of your stocks fall 40%, from $1.8 million to $1.08 million. Now, using the same calculation methodology, your stocks are going to need to eclipse a 22% annual return! While this is not out of the question, it is certainly not the norm. Any time your portfolio experiences a reduction in principal, either due to market downturns or discretionary selling, your hurdle rate will increase. The bottom line is that, in order to live comfortably off your assets, you need to grow the base, or at least not shrink it. This is why financial advisors evangelize the 4% rule, as it provides the necessary guardrails to preserve the earning power of your portfolio.

Impact on Portfolio During Down Markets

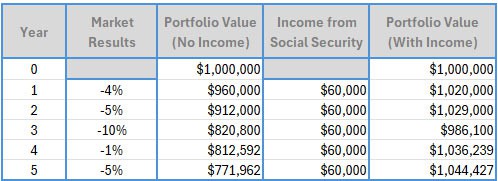

The following table (Exhibit 2) illustrates the impact of a hypothetical prolonged (5 year) down market on a $1,000,000 portfolio with and without a $60,000 annual income stream, which equates to the income typically received annually through Social Security:

Exhibit 2

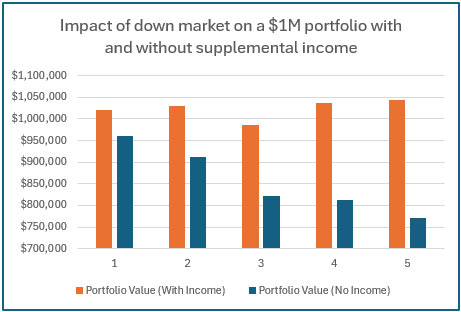

After 5 years, the portfolio with no Social Security income has underperformed the portfolio with income by over $270,000. Or stated in terms of overall results, the portfolio with the additional income stream outperformed by nearly 27% over the 5 year period (see exhibit 3)

Exhibit 3

Tax Considerations and Income Strategies

Generating income in retirement also involves tax considerations. Different sources of income are taxed differently, impacting overall financial planning:

- Tax-Deferred Accounts: Withdrawals from traditional IRAs and 401(k)s are taxed as ordinary income. Managing these withdrawals carefully can optimize tax efficiency.

- Tax-Free Accounts: Roth IRAs provide tax-free income, which can be strategically used to minimize taxable income during retirement.

- Taxable Accounts: Dividends and capital gains from taxable accounts are subject to preferential tax rates. Using these accounts for income can reduce the overall tax burden.

Conclusion

Income is a vital component of a successful retirement strategy. It provides financial stability, reduces the need for portfolio withdrawals during market downturns, and mitigates the risk of negative compounding. By carefully planning and diversifying income sources, retirees can enhance their financial security and maintain their standard of living throughout retirement. Strategic use of Social Security, pensions, dividend-paying stocks, and bonds can create a robust income plan that supports long-term financial goals.