When investors think about building wealth, they often consider up-market growth, or how much they will achieve if the markets rise. When markets are up, one of the first things investors do is see what their returns are for the day, month, or year. While a rally is always welcome, long-term success of a portfolio isn’t built on short rallies in certain sectors. History has proven time and again that rallies in sectors come and go. What may seem right in the short-term often fails in the long-term. One example of this was the NASDAQ bubble in early 2000 that was driven by the growth of dot-com companies. This ended with three consecutives years down more than -30%, losing more than 73% of value from 2000-2002. Just before the bubble burst, the success of the NASDAQ seemed certain.

Up-capture (performance in rising markets) is only one part of the three-act play including down-market capture and down-market recovery. These three factors drive long-term success and compounding. The two ingredients for successful compounding during these three market phases are portfolio efficiency and investor behavior.

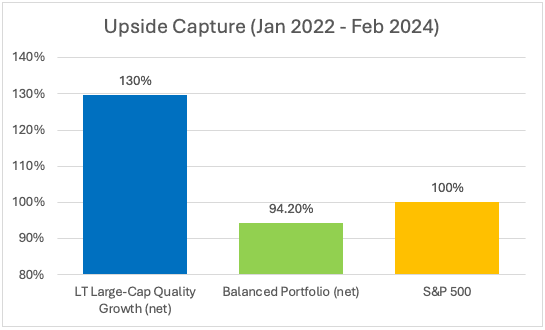

Upside Capture

Upside capture is the participation an investor has when the market rises. If the market is up 10%, and you’re up 6%, then your upside capture is 60% of the market. While upside capture is important, it is only one part of success, and in many ways, it is not the most important factor of long-term compounding. When a portfolio rallies, but then declines significantly, the net result may not be positive. Investors seeking long-term wealth can’t use upside capture as their only measurement; down-side capture and down-market recoveries are equally (if not more) important. Below you can see how a balanced portfolio only captured 94.2% of the upside versus 130% for the Linden Thomas Large-Cap Quality Growth , meaning the Large-Cap Quality Growth Index outperformed the balanced portfolio during this rally:

(Time period shown is for illustrative purposes only. Past performance is not indicative of future results. You cannot invest directly in an index)

Linden Thomas Large Cap Quality Growth I50 Index, net of fees, compared to a balanced portfolio (25% Linden Thomas US Equity Large-Cap Quality Growth 50 Index, 25% Linden Thomas US Equity Small Cap Quality Value 50 Index, 25% Linden Thomas Quality Dividends US Large-Cap Index, and 25% Linden Thomas Quality Dividends US Mid-Cap Index), net of fees. You cannot invest directly in an index. Source: Zephyr.

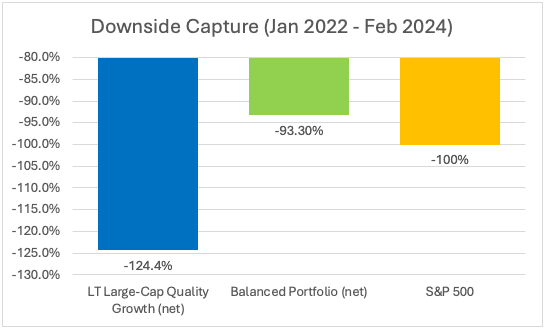

Downside Capture

Downside Capture is the opposite of up-capture. It is the amount your portfolio declines when the markets are down. If the market is down -20% and your portfolio is down -10%, your downside capture is 50% or half of the market. Why is this important in building long-term wealth? Because if you’re down -10%, then you need a +20% gain to return to your breakeven value. Unfortunately, investors too often seek results without considering down-market capture. This is why downside capture should always be considered when building a portfolio. Below you can see how the balanced portfolio only captured 93.3% of the downside when compared to the Large-Cap Quality Growth index’s 124.4%:

Linden Thomas Large Cap Quality Growth 50 Index, net of fees, compared to a balanced portfolio (25% Linden Thomas US Equity Large-Cap Quality Growth 50 Index, 25% Linden Thomas US Equity Small Cap Quality Value 50 Index, 25% Linden Thomas Quality Dividends US Large-Cap Index, and 25% Linden Thomas Quality Dividends US Mid-Cap Index), net of fees. You cannot invest directly in an index. Source: Zephyr.

(Time period shown is for illustrative purposes only. Past performance is not indicative of future results. You cannot invest directly in an index)

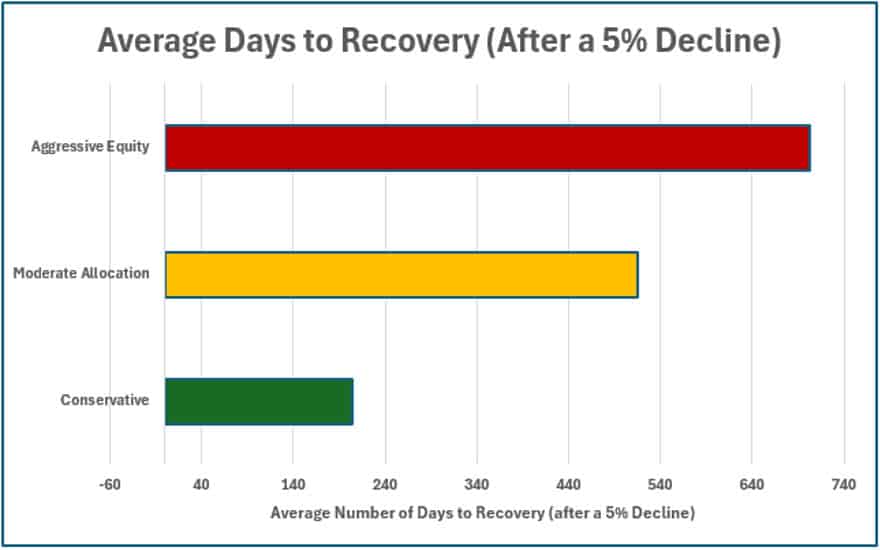

Down-Market Recovery

Down-Market Recovery is how long a portfolio takes to return to its pre-pullback value. Wealth and compounding are only achieved when you are building on your original value. Growth isn’t restored until you get back to the starting line. Too often risk and portfolio recovery aren’t considered in a plan for long-term wealth accumulation. Only when a portfolio is restored to its original value does excess compounding restart. Like a NASCAR race, success don’t always come from having the fastest car – it’s also how quickly you get out of the pit and back in the race. When a portfolio goes down, your first goal should be to get back on track by restoring principle:

(Source: Zephyr. Moderate Allocation: 30% S&P 500, 40% Bloomberg US Aggregate Bond Index, 30% Dow U.S Select Dividend; Aggressive Allocation: 40% S&P 500, 30% NASDAQ 100, 15% Russell Mid Cap, 15% Russell 2000; Ultra Conservative: 100% Bloomberg US Aggregate Bond Index)

Which of these Three Factors are Most Important?

While all these factors are important, it may surprise some readers that often up-capture is overvalued. If you achieve great results when the markets are up, but are unable to hold onto the gains, then the results are meaningless. Too often investors chase hot sectors or stocks and achieve good short-term results to accompany the market hype. A few years later they may find that it was an inflated balloon waiting to pop. Popped balloons don’t float! Wealth isn’t built in a moment; it’s built with a quality portfolio over time. Upside results feel good for a season, but just like the seasons markets move through cycles. It’s important to achieve results and keep the gains. Downside and down-market recovery generally are the most important factors for building long-term wealth.

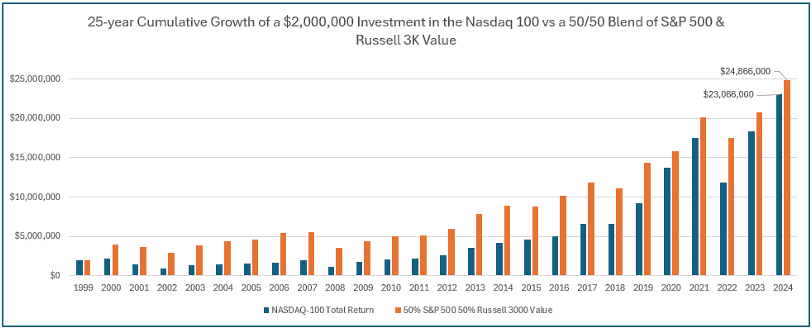

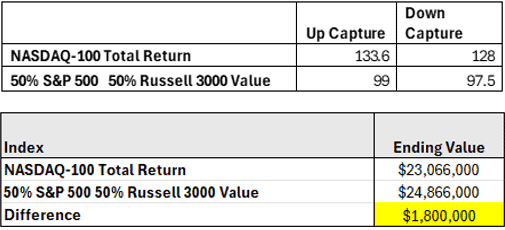

A person earning a steady 6% with 50% less risk in the market, and a high down-market recovery percentage, will often outperform a portfolio that often outperforms but with high risk and poor recovery characteristics. Below is an illustration of a portfolio built on the NASDAQ-100 compared to a portfolio composed of 50% S&P 500 and 50% the Russell 3000 Value:

(Time period shown is for illustrative purposes only. Past performance is not indicative of future results. You cannot invest directly in an index)

As you can see above, the long-term compounding over a full market cycle for the NASDAQ-100 Total Return underperformed the 50/50 portfolio, despite the NASDAQ portfolio having a greater upside capture. The down-market capture and down-market recovery characteristics were more important.

What Drives Upside Capture, Downside Capture, and Down-Market Recoveries?

7 Factors of Portfolio Efficiency

Long-term success of an investor’s portfolio always stems from the 7 factors making the fabric of the Linden Thomas & Co. discipline. These 7 factors of efficiency are at the center of each institutional and fixed income portfolio.

1. Quality of Equity Holdings – Time has proven that good companies deliver the better long-term results, so high-quality earnings growth should be prioritized. Short-term spikes in a company’s value, without the earnings to back it up, often end poorly. This is why earnings quality is at the core of our earnings-focused indexes.

2. Sector Diversification – Sectors move in and out of favor. This can tempt investors to chase results that have already occurred. When sectors rotate into and out of favor, they often do so at different times. For example, with growth stocks are up value stocks may lag behind, and vice versa. Over the long-term growth, value, small-cap, mid-cap, and large-cap companies complement each other to aid in compounding.

3. Ownership – Investors who don’t own their holdings directly and are investing in pooled investment products seldom realize the importance of direct ownership. Owning stocks and bonds directly instead of investing in ETFs or mutual funds can insulate you from other investors’ behavior and help long-term results. When markets move down, investors you can’t see or control may be selling, which impacts results, the internal costs of the fund, and potential pass-through taxes. The Linden Thomas & Co. institutional direct separately-managed-accounts give investors direct ownership and control of their holdings.

4. Cost – Historically investors only consider the expense ratio of mutual funds and ETFs, without considering disadvantages like internal trading costs, investment advisor fees, lack of quality, or internal trade spreads. Large fund companies often promote low expense ratios but seldom discuss the impacts of trading fees and delistings on results. This is why Linden Thomas built an earnings-focused index with a focus on the quality of holdings and eliminating the hidden costs of retail investment products.

5. Fixed Income Ownership and Yield – When an investor owns bonds with a focus on delivering net-income, the income becomes a resource during down-markets. This means that when asset classes are down, the income provides a way to add to bond or equity positions during the dips. Bonds’ price stability and cashflow create balance and a way of dollar-cost-averaging during market pullbacks.

6. Investor Behavior – Even with an efficient portfolio, investors won’t see good results unless they control their behavior. Meaningful results are only achieved if the investor has the patience not to chase returns or get impatient during pullbacks. This is why we believe portfolio efficiency and behavior are equally important; having one without the other won’t cut it.

7. Time in the Market (Full Market Cycles) – Time is an investor’s friend. Long-term wealth is not achieved in short sprints, it’s achieved over long-term periods and full market cycles. Spreading risk, buying quality holdings, and adding to positions over time is how investors achieve wealth. Three decades of helping investors build wealth has shown that up and down-markets don’t last, and real growth requires accumulating holdings over time and being patient.

Why did Linden Thomas & Co. build earnings-focused equity indexes and yield-focused bond indexes? Because the three factors of portfolio results (upside, downside, and down-market recoveries) work together to enhance long-term compounding, but require portfolio efficiency.

Long-term results are directly correlated to portfolio efficiency.