Investing can be both rewarding and challenging, especially when navigating complex markets. Many investors begin their journey with strong intentions and optimistic goals, only to fall short due to missteps that could have been avoided. After decades of helping clients, at Linden Thomas & Co. we’ve observed recurring errors that we believe undermine even the best-laid investment strategies. Let’s break down these 10 common investor mistakes and how affluent investors can sidestep them.

1. Chasing Hype

Investors often get caught up in popular trends, whether it’s a rapidly rising stock, an emerging sector, or the latest “hot tip.” Take, for instance, the dot-com bubble when tech stocks seemed unstoppable until they abruptly collapsed erasing billions in investor wealth. Chasing hype is risky–when you hear about a stock that’s been soaring, the opportunity for substantial gains may have already passed. We believe it is better to focus on fundamental value rather than the excitement of trends, as quality investments outlast short-lived hype.

2. Chasing Average Returns

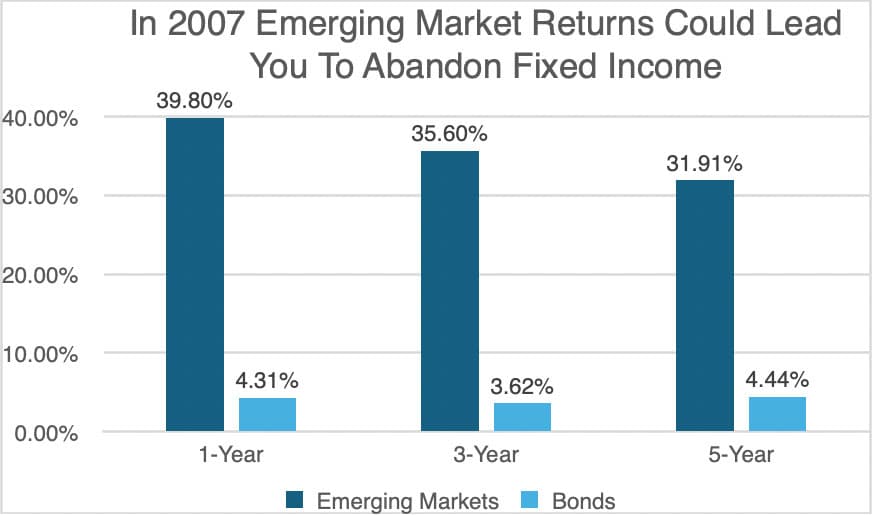

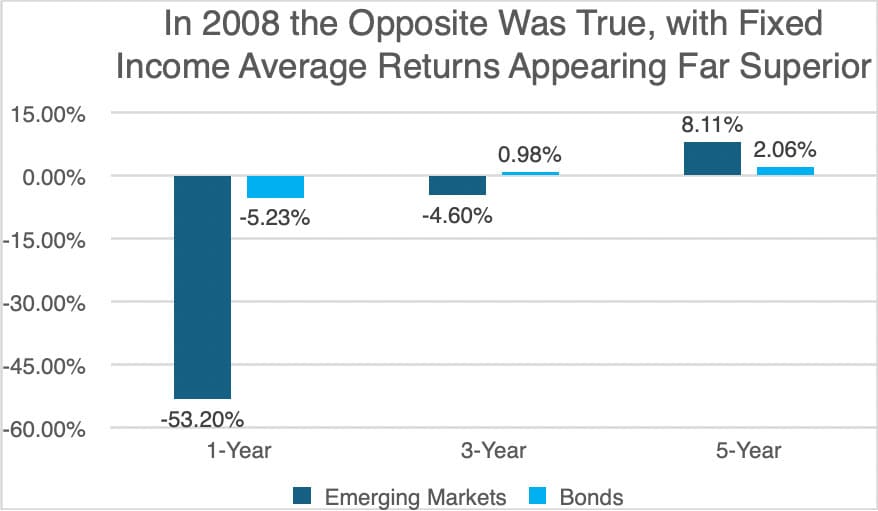

Although past performance is not an indicator of future results, many investors use average returns to determine if their investment is going to do well in the future. While returns are important, chasing average returns can be risky. Because average returns go up and down based on recent rallies or pullbacks, investors can be misled into thinking those returns will continue. If a sector rallies over 12 months, then the 1-, 3-, 5-, and 7-year returns improve, making some investors believe that the sector will continue to do as well in the future.

On the other hand, a pullback in a fund or sector in a 12-month period drags down the average returns. This can leave investors believing they should sell the laggers and invest in the sectors where the average returns are higher. All too often this behavior just leads to selling low and buying high. This behavior is exacerbated by the “recency effect”, leading investors to place more emphasis on recent results than they should. If investors aren’t careful, they could be changing their strategy based on what has already happened, not what has yet to happen.

The chart below helps illustrate the dangers of assuming that one asset class will outperform another asset class, simply because that’s what happened in the current time period. This chart shows how emerging markets crushed fixed income in 2007 only to see a complete reversal a year later, when fixed income beat emerging markets by over 93%.

Source: Zephyr

Source: Zephyr

It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. All investments are subject to risks, including the risk of loss. Past performance is not indicative of future results. Emerging Markets: MSCI EAFE. Bonds: Bloomberg US Agg Bond TR USD.

3. Overconcentration

When a portfolio is heavily concentrated in a single sector, asset class, or company, it’s vulnerable to market shifts. If a once-strong sector dips, overconcentration can turn significant gains into drastic losses. For instance, investing heavily in tech stocks during a booming market may feel rewarding, but a balanced approach–mixing tech with stable sectors like consumer goods–can provide more security if the tech sector cools. Diversification spreads risk and builds a portfolio that can weather a range of market conditions.

4. Neglecting Downside Risk

Focusing on potential gains while ignoring downside risks can be a costly oversight. Markets go through cycles, and down markets are inevitable. Investors often ignore the risk of their securities losing value, and instead focus on chasing high returns without preparing for potential declines. A portfolio that balances growth with defensive assets can soften the blow during downturns and help protect gains over time.

5. Media Influence

The media can exacerbate investor fears, especially during market volatility. Headlines about downturns or crashes can trigger panic-selling, while reports of record highs can lead to buying at inflated prices. Relying on media-driven market signals often results in reactionary decisions rather than measured, strategic moves. Investors should stay focused on their long-term goals and ignore sensationalized headlines that feed anxiety rather than insights.

The media can influence investors to chase returns. One example of this was prior to the dot-com bubble. The media was publishing the recent rallies of tech companies and urging investors not to miss the returns of the new tech world that was forming. Chasing the dot-coms, however, would have been a mistake. Soon after the media frenzy, the dot-coms lost significant value and many of these companies failed.

6. Fear of Loss in Down Markets

It’s natural to feel anxious during down markets, but selling investments due to fear can lead to missed opportunities. When market prices drop, investors may actually be presented with a chance to buy quality stocks at lower valuations. Imagine seeing a high-value home in a desirable area go on sale at half price–an experienced investor would see this as an opportunity, not a sign to sell their current home. Similarly, down markets offer entry points to high-quality assets at attractive prices, allowing the opportunity for wealth growth during market rebounds.

7. Market Timing

Attempting to predict when markets will rise or fall is a notorious pitfall. Rarely, if ever, do investors successfully time the market on a consistent basis. Missing even a few of the market’s best days can have a profound effect on long-term returns. Rather than trying to time their entry and exit points, investors should focus on staying in the market to benefit from compounding returns over time. We believe consistency and patience are far more reliable than the elusive goal of perfect timing.

8. Relying on “Experts”

Financial “gurus” often promote high-return schemes or market predictions that seem appealing in the short term but lack a solid foundation. Quick gains may occur occasionally, but building long-term wealth requires a disciplined approach based on time-tested strategies. Following fundamentals–such as focusing on quality investments, diversifying, and taking a long-term view–is more sustainable than chasing “get-rich-quick” advice.

9. Ignoring Quality

Investing in quality companies is crucial for building wealth. Quality stocks–those with solid balance sheets, consistent earnings, and strong market positions–are more likely to withstand economic downturns. Speculative stocks, on the other hand, may appear attractive during bull markets but often crumble during downturns. Companies with reliable earnings and manageable debt are better positioned to navigate turbulent periods, making quality a cornerstone of any successful investing strategy.

10. Buying Only When It Feels Good

Adding to an investment portfolio during market highs may seem safer, but the real wealth-building opportunity often lies in buying during downturns. Consider it a “buy on sale” approach: when markets dip, quality investments become available at discounted prices. Although it’s counterintuitive to buy when others are selling, doing so aligns with the age-old strategy of buying low and holding for the long term. A balanced portfolio, combined with periodic investments during market dips, can help maximize returns over time.

Conclusion

Investment outcomes rely not only on a well-constructed portfolio but also on avoiding common investor mistakes. The strategies outlined here, while not guaranteed, have proven effective for affluent investors by prioritizing discipline, patience, and a clear focus on long-term goals. At Linden Thomas & Co., we help guide clients in navigating these challenges with a resilient, well-diversified approach that can withstand market cycles. Remember, while a balanced portfolio is essential, avoiding emotional reactions and focusing on quality investments are often the keys to unlocking consistent success.